Vostro and Nostro accounts are used for the settlement of payments between banks on account of international trade and other cross-border payments.

What Are Vostro and Nostro Accounts?

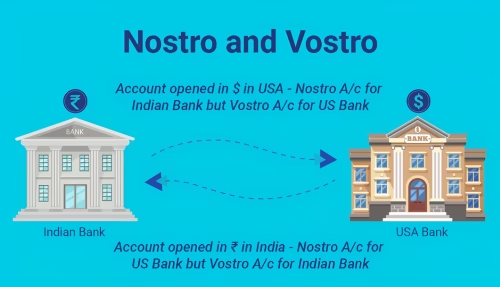

In simple terms, both the Vostro and Nostro accounts are similar terms used for the same account with different perspectives.

The term “Vostro” originates from the Latin phrase “Vostro Signore,” which translates into “Their Account.”

A Vostro account is an account held by a foreign bank with a domestic bank in domestic currency, the currency of the specific country or geography where the account is maintained. It loosely stands for “their account with us.”

So, the account that a bank in the European Union, let us say France, maintains with its Indian correspondent bank in India in INR is a Vostro account for the Indian bank.

The term “Nostro” originates from the Latin phrase “Nostro Signore,” which translates into “Our Account.”

A Nostro account is a specialised account held by a domestic registered bank with a foreign bank in any foreign currency, the currency of the specific country or geography where the account is maintained.

Example: If Bank A has an account with Bank B in Australia, Bank A’s account in Bank B is maintained in Australian dollars. Bank A’s account with Bank B is known as a Nostro account.

It loosely stands for “our account with them.” So, the account that an Indian bank maintains with its American correspondent bank in the United States of America in USD is a Nostro account for the Indian bank.

Today, Vostro and Nostro accounts are the backbone of worldwide banking operations and facilitate seamless interaction and payment settlement between domestic and foreign banks and financial institutions.

Vostro and Nostro accounts are an integral part of the global cross-border payment ecosystem, as no bank can have its branches in all the countries where it facilitates the transfer of funds.

Correspondent banking arrangements are set up to address this issue, but often, even such an arrangement ends up complicating matters. As local branches are not available for settlement, cross-border payments are settled through the Nostro and Vostro accounts.

What Are the Benefits of Vostro and Nostro Accounts?

Facilitation of International Trade and Foreign Payments

Nostro and Vostro accounts are used for the settlement of payments between banks on account of international trade and other cross-border payments. They simplify the settlement process.

Mitigation of Currency Risks

Banks and financial institutions maintain the Nostro and Vostro accounts, and a certain balance is regularly maintained. It helps hedge the risk of fluctuations in the foreign exchange rate to some extent, as conversions from foreign currency are not required during the settlement.

Enhanced Correspondent Banking Relationship

Correspondent Banking relationships are improved as an arrangement of Nostro and Vostro accounts leads to greater quality and instances of interactions between correspondent banks.

Nostro and Vostro accounts may be between any pair of currencies such as INR and USD (United States Dollar), INR and Euro, INR and GBP (Great Britain Pound), INR and JPY (Japanese Yen), INR and SGD (Singapore Dollars) and so on. The State Bank of India lists 51 Nostro accounts for 22 currencies on its website.

Vostro Accounts for Settlement of International Trade

You will recall that the Russian invasion of Ukraine has resulted in severe trade and economic sanctions being imposed upon the former country. Russian banks have been barred from participating in the SWIFT network, the global financial messaging system that is the backbone of cross-border payments today.

Given this scenario, Russia has been forced to trade with very few countries, India being one of them.

As the SWIFT network is not available for Russian banks, importers are not able to use that route to send their payments.

To circumnavigate this blockage and to facilitate trade between INR and Russian Roubles, the Reserve Bank of India has permitted the opening of 20 Special Rupee Vostro Accounts with Russian banks such as Gazprom, Rosbank, Tinkcoff Bank, Centro Credit Bank, and Credit Bank of Moscow in 2023.

It is an additional arrangement to the settlement system already in existence to facilitate the use of INR in the settlement of international trade.

Such banks allowed to open the accounts are subject to screening of their financial health, business strength, experience, and capacity in handling foreign trade transactions, as well as their existing correspondent bank relationships.