National Income is nothing but the total income accruing to a country from economic activities in a year’s time. It includes payments made to all the factors of production namely the land, labour, capital and enterprise in the form of rent, wages, interest, and profits respectively.

Computation of National Income is very vital as it indicates the overall health of our economy for that particular year.

National Income – Definition

National income is a measure of value of production activity of a country.It is in the production process of goods and services that income is generated or we can say production generates income.

Remember, production is the result of combined efforts of four primary inputs, also called factors of production—land, labour, capital and enterprise.

Whatever is produced jointly by factors of production, the same gets distributed among them as factor income in the form of rent, wages, interest and profit.

Since factors of production are paid their remuneration out of what they have produced, it is said that income is generated in the production process.

This is how income is first generated in the production process and then distributed among factor owners for rendering productive services. Income gives rise to expenditure for purchase of goods and services to satisfy wants.

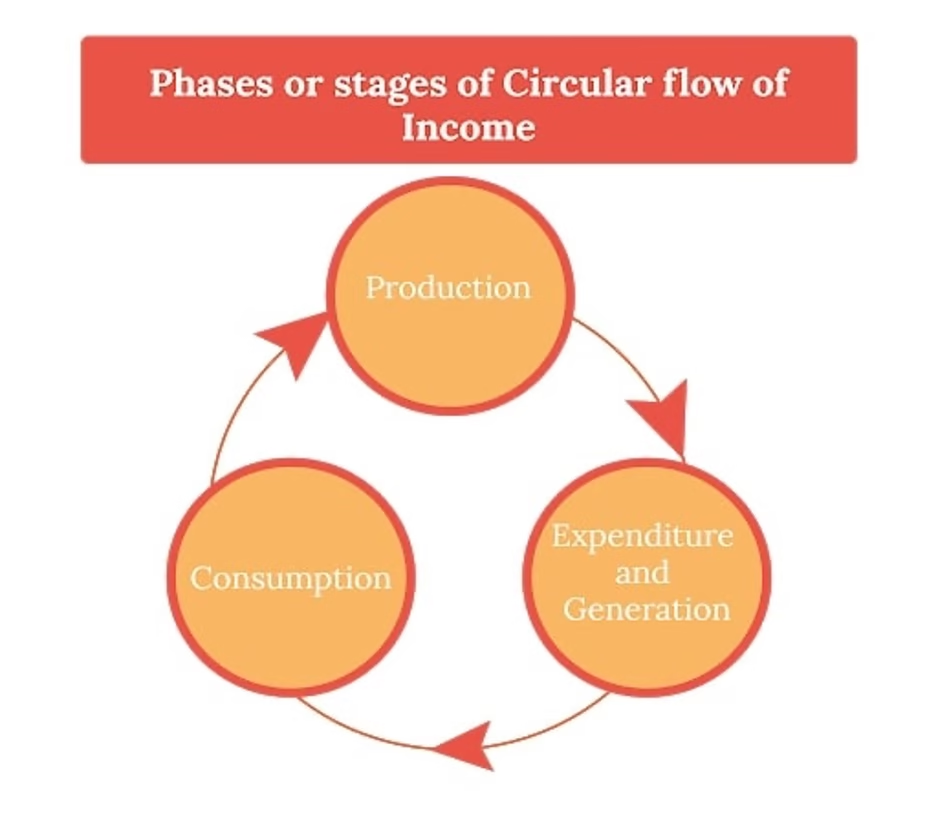

Expenditure, in turn, leads to further production. In this way, there are three phases in circular flow of national income—production phase, income phase and expenditure phase.

Accordingly, national income can be defined in three different ways—as a flow of goods and services produced, as a flow of income (distributed) and as a flow of expenditure as described here:

1. From production point of view, “National income is the sum of money value of net flow of all the final goods and services produced by normal residents of a country during a period of account.” (National income is briefly a measure of production activity.)

2. From income point of view. Central Statistical Organisation (CSO) has defined, “National income is the sum of factor incomes earned by normal residents of a country in the form of rent, wages, interest and profit in an accounting year.”

3. From expenditure (disposition of national income) point of view, Simon Kuznets defines thus, “National product is the net output of commodities and services flowing during the year from the country’s productive system into the hands of ultimate consumers or into the net addition to the country’s capital goods.” It is calculated by adding up final consumption expenditure and final investment expenditure on final goods and services produced by normal residents of a country in an accounting year.

In short, national income is either money value of all the final goods and services produced or the sum total of all factor incomes earned or the sum total of final expenditure (consumption expenditure + investment expenditure).

Why Measure National Income?

- It is valuable in assessing the performance of different production sectors e.g. the production units of a country are broadly classified into primary, secondary and tertiary sectors. These sectors generate incomes. The data on incomes generated by these sectors can be used to measure their relative contributions to national income.

- Helpful in Economic Planning e.g. every country makes planning for economic progress. Planning is not possible without statistical data of economy.

Factor Income and Non-factor Income

In an economy we receive different types of incomes.

We receive wages and salaries from our employers. We receive interest on capital for lending money. We receive profits from business, Rents from physical property.

We also receive gifts and donations from others without giving anything.

All these incomes can be grouped into two types of incomes.

(A) Factor incomes

(B) Non-factor incomes

(A) Factor Incomes: A factor income is the income accruing to a factor of production in return for the services rendered to the production unit. This production is result of the joint efforts of the four factors of production.

(B) Non- factor Incomes: There are certain money receipts which do not involve any sacrifice on the part of their recipients, the examples are gifts, donation charities, taxes, fines etc. No production activity is involved in getting these incomes.

These incomes are called transfer incomes(transfer payments) because such income merely represent transfer of money without any good or service being provided in return for the receipts. These incomes are not included in national income.

What are Transfer Payments

Here you have to note that he transfers payments differ from other payments to individuals for which either a service (including labour services) is performed in return for such payments or a good is exchanged. Transfer payments can originate from either business or government sources.

Business transfer payments include corporate gifts to non-profits institutions, payment for personal injury, and taxes paid by domestic corporation to foreign government. Government transfer payments include social security; government employee, military, and railroad retirement pensions; unemployment insurance; veterans’ benefits; workers’ compensation; cash public assistance etc.

By their very nature, government transfer payments are excluded from the calculation of a nation’s gross domestic product (GDP) since they do not represent compensation for the production of currently produced goods and services.

Why they are called Transfer Payments? To be exact, the transfer payments represent a redistribution of income taking money away from taxpayers and giving it to others who are eligible for the various program

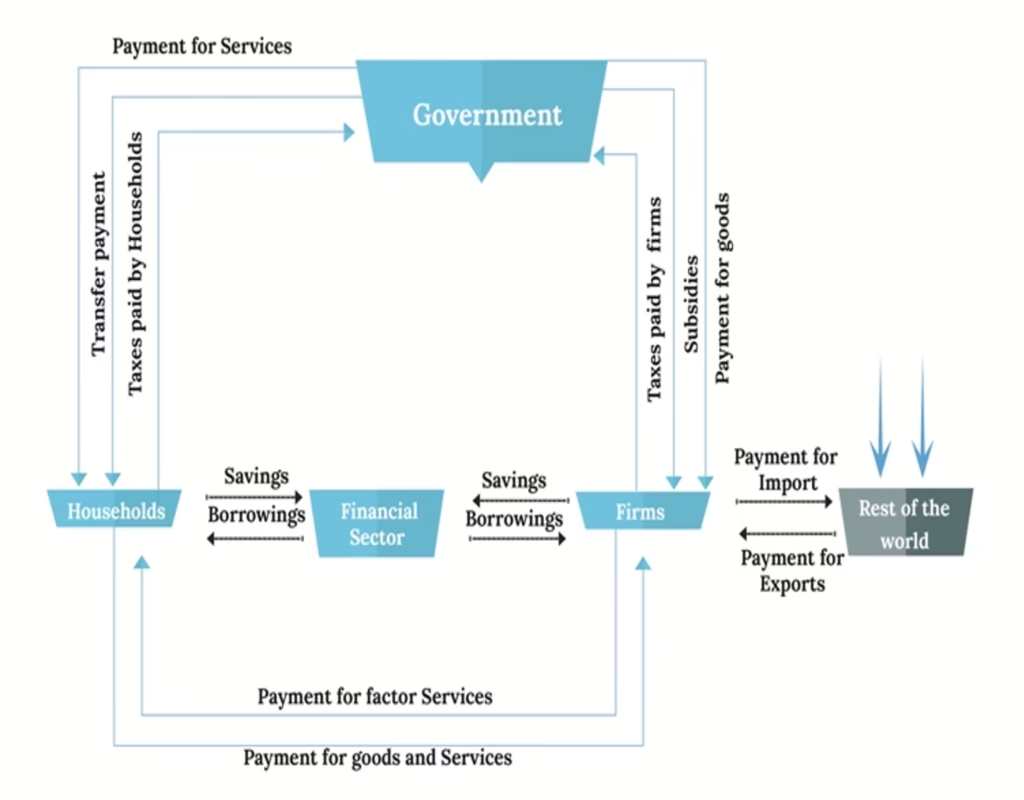

Circular Flow of Income

Circular flow of income refers to the continuous circulation of production, income generation and expenditure involving different sectors of the economy.

- Production phase, In this phase, firms produce goods and services with the help of factor services.

- Income phase, this phase involves the flow of factor income (rent, wages, interest and profits) from firms to the households, who owns the means of production.

- Expenditure phase, In this phase, the income received by factors of production, is spent on the goods and services produced by firms.

Income is first generated by production units, then distributed to households and finally spent on goods and services produced by these units to make the circular flow complete its course.

Circular Flow of Income: Two – Sector Economy

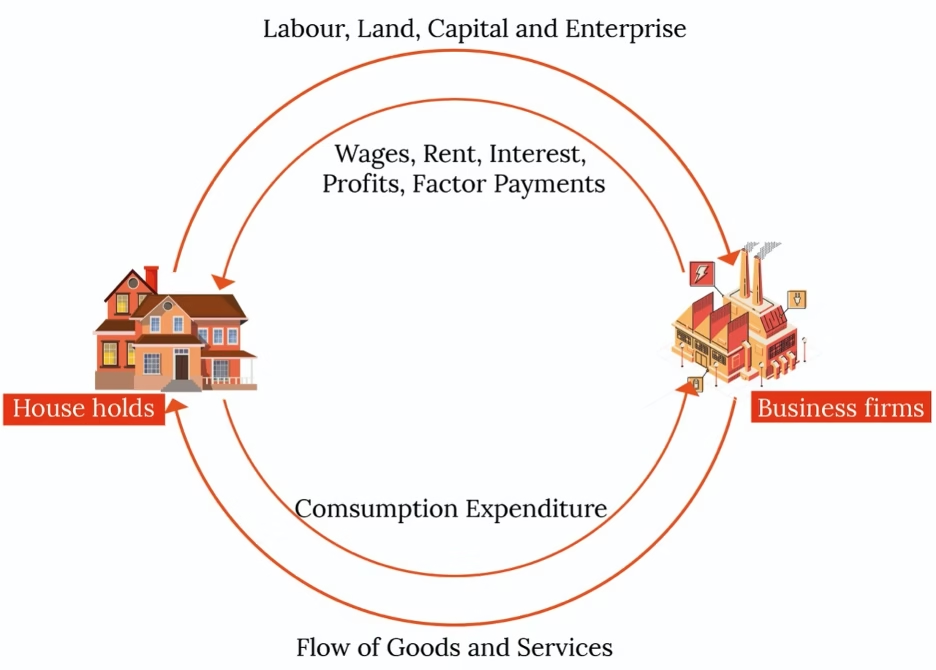

The circular flow model in the two-sector economy is a hypothetical concept which states that there are only two sectors in the economy, household sector and business sector (business firms).

- The household sector is the source of factors of production who earn by providing factor services to the business sector.

- The business sector refers to the firms that produce goods and services, and receive income by supplying the produced goods to the household sector.

The two sector economy has the following assumptions:

- There are only two sectors in the economy; household sector and business sector.

- No government interventions over the economic activities.

- Business sectors do not carry out any import or export activities, creating a closed economy.

In the lower part of the figure, money flows from households to firms as consumption expenditure made by the households on the goods and services produced by the firms, while the flow of goods and services is in opposite direction from business firms to households.

Thus we see that money flows from business firms to households as factor payments and then it flows from households to firms. Thus there is, in fact, a circular flow of money or income. This circular flow of money will continue indefinitely week by week and year by year.

In our above analysis of the circular flow of income we have assumed that all income which the households receive, they spend it on consumer goods and services. As a result of circular flow of money, spending and income remains undiminished.

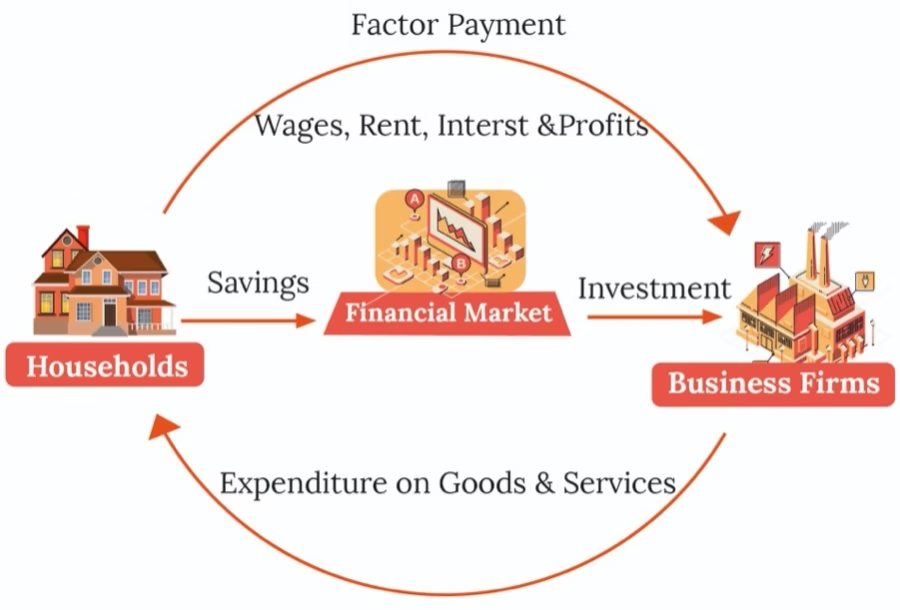

We will see what happens if the households save a part of their income, how their savings will affect money flows in the economy. When households save, their expenditure on goods and services will decline to that extent and as a result money flow to the business firms will contract. With reduced money receipts, firms will hire fewer workers (or lay off some workers) or reduce the factor payments they make to the suppliers of factors such as workers.

This will lead to the fall in total incomes of the households. Thus, savings reduce the flow of money expenditure to the business firms and will cause a fall in economy’s total income. Economists therefore call savings a leakage from the money expenditure flow. But savings by households need not lead to reduced aggregate spending and income if they find their way back into flow of expenditure.

In free market economies there exists a set of institutions such as banks, insurance companies, financial houses, stock markets where households deposit their savings. All these institutions together are called financial institutions or financial market. We assume that all the savings of households come in the financial market. We further assume that there are no inter-households borrowings.

It is business firms who borrow from the financial market for investment in capital goods such as machines, factories, tools and instruments, trucks. Firms spend on investment in order to expand their productive capacity in future.

Thus, through investment expenditure by borrowing the savings of the households deposited in financial market, are again brought into the expenditure stream and as a result total flow of spending does not decrease. Money flow of savings is shown from the households towards the financial market. Then flow of investment expenditure is shown as borrowing by business firms from the financial market.

Circular Flow of Income: Three-Sector Economy

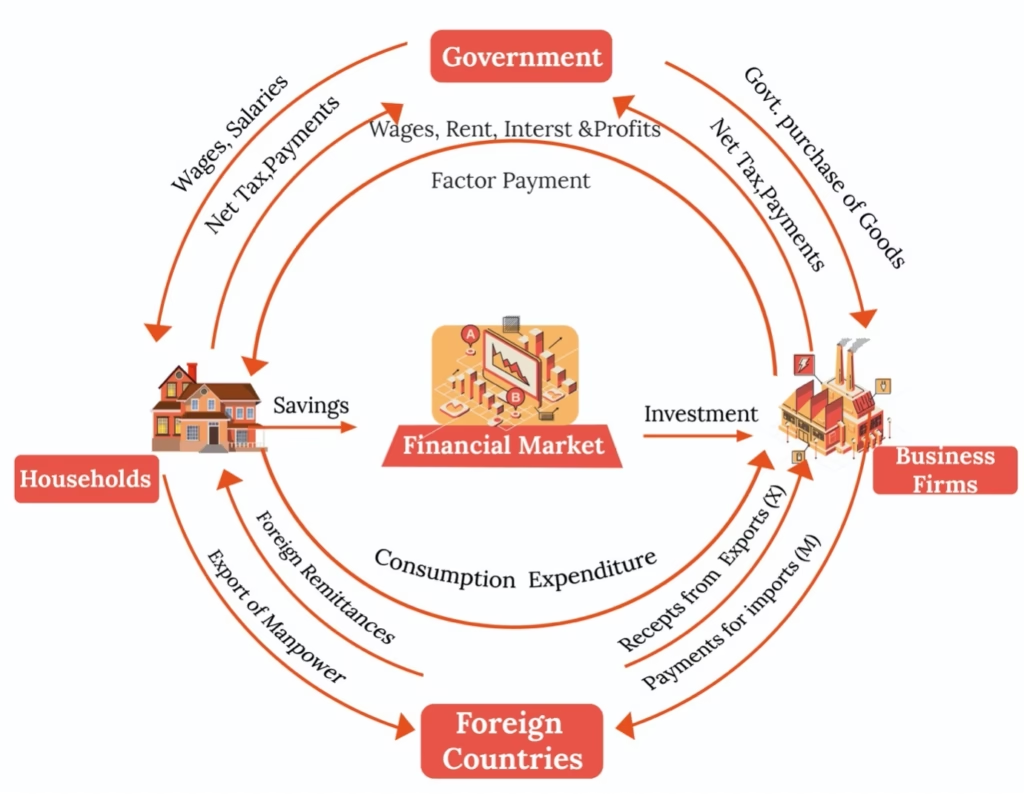

In our above analysis of money flow, we have ignored the existence of government for the sake of making our circular flow model simple. This is quite unrealistic because government absorbs a good part of the incomes earned by households. Government affects the economy in a number of ways by doing taxing, spending and borrowing roles.

Government purchases goods and services just as households and firms do. Government expenditure takes many forms including spending on capital goods and infrastructure (highways, power, communication), on defence goods, and on education and public health and so on.

Government expenditure may be financed through taxes, out of assets or by borrowing. The money flow from households and business firms to the government is labelled as tax payments. The other method of financing Government expenditure is borrowing from the financial market. This can be represented by the money flow from the financial market to the Government and is labelled as Government borrowing. Government borrowing increases the demand for credit which causes rate of interest to rise.

Circular Flow of Income: Four- Sector Economy

The circular flow model in four sector economy provides a realistic picture of the circular flow in an economy. Four sector model studies the circular flow in an open economy which comprises of the household sector, business/firms, government, and foreign sector.

Let’s try to understand the money flows that are generated in an open economy, that is, economy which have trade relations with foreign countries. Thus, the inclusion of the foreign sector will reveal to us the interaction of the domestic economy with foreign countries. Foreigners interact with the domestic firms and households through exports and imports of goods and services as well as through borrowing and lending operations through financial market.

Goods and services produced within the domestic territory which are sold to the foreigners are called exports. On the other hand, purchases of foreign-made goods and services by domestic households are called imports.

The additional money flows that occur in the open economy when exports and imports also exist in the economy. In our analysis, we assume it is only the business firms of the domestic economy that interact with foreign countries and therefore export and import goods and services.

If exports are equal to the imports, then there exists a balance of trade. Generally, exports and imports are not equal to each other. If value of exports exceeds the value of imports, trade surplus occurs. On the other hand if value of imports exceeds value of exports of a country, trade deficit occurs.

In the open economy there is interaction between countries not only through exports and imports of goods and services but also through borrowing and lending funds or what is also called financial market. These days financial markets around the world have become well integrated.

Go through the below diagrams to revise the circular flow of Income.

Value of Output and Value Added

Value of Output: Production units use non-factor inputs like raw materials (intermediate goods) and factor inputs (factors of production i.e. land, labour, capital and entrepreneurship) for production. Various firms and production units produce different types of goods. Money value of all goods and services produced is known as value of output. (It means value of output includes value of intermediate goods also).

Thus; Value of output = Quantity × Price

Producing units sell their output in the market. However, it is not necessary that the whole of the output produced during an accounting year is sold during that very year. Therefore, the unsold produce forms a part or the stock or inventories. So, change in stock or inventories is also a part of value of output. Thus, value of output can also be measured as, Value of output = Sales + Change in stock

It is clear that value of output includes value of intermediate consumption also. National income does not include intermediate consumption expenditure. So for calculation of National Income it must be deducted from value of output to avoid the problem of double counting.

Value Added: After deducting value of intermediate goods from value of output we get value added. So, value added is the difference between value of output and intermediate consumption expenditure.

Value Added = Value of output – Intermediate Consumption Expenditure

The concept of Value of Output and Value Added can be explained with the help of an example. Suppose a farmer produces cotton worth Rs.500 and sells it to the cloth mill. The cloth mill produces cloth worth Rs.1,500. (Say produces 300 metres of cloth and market price of cloth is Rs.5 per meter). But in this value, value of cotton is also included and cotton used by cloth mill is an intermediate good so value of cotton i.e. Rs.500 will be intermediate cost.

Therefore value added will be Rs.1500 – Rs.500 = Rs 1,000.

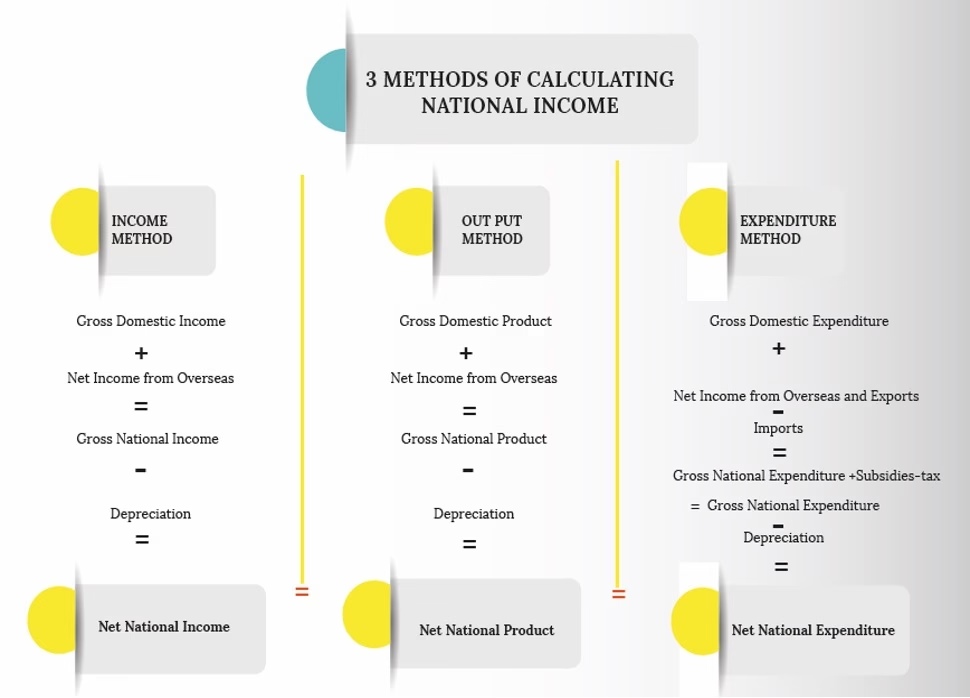

Methods of Measuring National Income

The production units produce goods and services, this production process generates income. Income is used for expenditure, and expenditure, in turn, leads to further production. These are three phases of circular flow of national income.

So there are three methods of measuring national Income. They are

- Output or Value-added method

- Income method

- Expenditure Method

Factor cost and Market price:

Factor cost: It is the actual cost incurred on goods and services that are produced by the firms and industries in an economy.

Market Price: The buyers purchase goods from the market and the price paid by them is known as ‘market price’: The sellers pay a part of this price as ‘indirect taxes’ to the Government.

- Factor cost = Manufacturing cost + Profit

- Market prices = Manufacturing cost + profit + Indirect tax – Subsidy

- Value Added at Factor cost (FC) = Value Added at Market Price – Net Indirect Tax (NIT) (or)

- Value Added at FC = Value Added at MP – Indirect Tax + Subsidy

Output Method (Value Added method)

This method approaches the measurement of national income through the value-added angle. The main steps involved in measuring national income through this method are as follows:

- Classify the production units located within the economic territory into the distinct industrial groups like agricultural, mining, manufacturing, banking, trade etc.

- Estimate the net value added at factor cost by the each industrial sector by talking the following sub steps:

- Estimate the value of output.

- Estimate the value of intermediate consumption and deduct the same from the value of output to arrive at gross value at market price.

- Gross value added at market price = Value of output – Value of intermediate consumption.

- Deduct consumption of fixed capital and indirect taxes and add subsidies to the gross value added at market price to obtain the net value added at factor cost.

- Net value added at factor cost = (Gross value added at market price + subsides) – (Consumption of fixed capital + Net indirect taxes)

- Take the sum of net value added at factor cost by all the industrial sectors to arrive at net domestic product at factor cost.

- Add net factor income received from abroad to the Net Domestic Product at factor cost to obtain Net National Product at factor cost which is the national Income.

Income Distribution Method

In this method, national income is measured at the stage when factor incomes are paid out by the production units to the owners of the factors of production.

The main steps involved in this method are as follows:

- Classify the production units into distinct industrial sectors like agriculture, forestry, manufacturing, Banking trade etc.

- Estimate the following factor incomes paid out by the production units in each industrial sector:

- Compensation of employees(Wages)

- Rent

- Interest

- Profit

The sum total of the above factor incomes paid out is the same as net value added at factor cost by the industrial sector.

- Take the sum of factor payments by all the industrial sectors to arrive at the net domestic product at factor cost.

- Add net factor income from abroad to the net domestic product at factor cost to arrive at the Net National product at factor cost.

Final Expenditure Method

National income can also be measured at the point of expenditure. According to this method, we first estimate domestic product at market price which is the total expenditure incurred on the final products produced within economic territory and used for consumption and investment. From this we deduct consumption of fixed capital and net indirect taxes and add net factor income received from abroad to get national income.

The final expenditure on consumption is classified into:

Consumption expenditure of households and consumption expenditure of the general government.

The expenditure on investment is classified into:

- Investment within the economic territory and

- Investment outside the economic territory.

The main steps involved in measuring national income by this method are:

- Estimate the following expenditure incurred on the final products of all the sectors of the economy.

- Private final consumption expenditure(PFCE)

- Government final consumption expenditure(GFCE)

- Gross fixed capital formation(GFCF)

- Net exports (Exports – imports)(NX)

The sum total of all the above expenditure on final products of all sectors of the economy gives us gross domestic product at market price.

- Deduct consumption of fixed capital(Depreciation), indirect taxes and add subsidies to the gross domestic product at market price(mp) to get net domestic product at factor cost(fc).

NDPmp = GDPmp – Consumption of fixed capital(Depreciation)

NDPfc = NDPmp – Indirect taxes + Subsidies

Add net factor income abroad to the net domestic product at factor cost to obtain net national product at factor cost which is the national income.

NNPfc = NDPfc + Net factor income from abroad

Gross Domestic Product (GDP)

GDP is the final value of the goods and services produced within the geographic boundaries of a country during a specified period of time, normally a year. GDP is sum of Consumption (C), Investment (I), Government Spending (G) and Net Exports (X-M).

Y = C + I + G + (X – M)

(or)

Y = PFCE + GFCF + GFCE + NX

Consumption(PFCE): Consumption is consisting of private (household final consumption expenditure) in the economy. These personal expenditures fall under one of the following categories: durable goods, non – durable goods, and services. Some examples are consumption expenditure in food, rent, jewellery, gasoline, and expenses.

Investment(GFCF): This includes construction of a new mine, purchase of software, or purchase of machinery and equipment for a factory. Spending by households (not government) on new houses is also included in investment.

Government Spending(GFCE): Government spending is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. However, it does not include any transfer payments, such as social security or unemployment benefits.

Exports and Imports(NX): X (exports) represents gross exports, GDP captures the amount a country produces, including goods and services produced for other nations’ consumption. Therefore, exports are added. M (imports) represents gross imports. Imports are subtracted since imported goods will be included in the terms C, I or G, and must be deducted to avoid counting foreign supply as domestic.

Intermediate goods are not included in the calculation of national income. Only final goods are included in the calculation of national income because value of intermediate goods is included in the value of final goods. If it is included in national income it will lead to the problem of double counting.

Savings and Investment

Saving is setting aside money you don’t spend now for emergencies or for a future purchase. It’s money you want to be able to access quickly, with little or no risk, and with the least amount of taxes. Financial institutions offer a number of different savings options.

Investing is buying assets such as stocks, bonds, mutual funds or real estate with the expectation that your investment will make money for you. Investments usually are selected to achieve long-term goals. Generally speaking, investments can be categorized as income investments or growth investments.

Potential GDP

An estimate of the value of the output that the economy would have produced if labour and capital had been employed at their maximum sustainable rates—that is, rates that are consistent with steady growth and stable inflation.

Determinants of Potential GDP

- Availability of Natural and Human Resources

- Capital to Output Ratio

- Consumption Capacity

- Technological Progress

- Inflation

Factors inhibiting India reach its potential

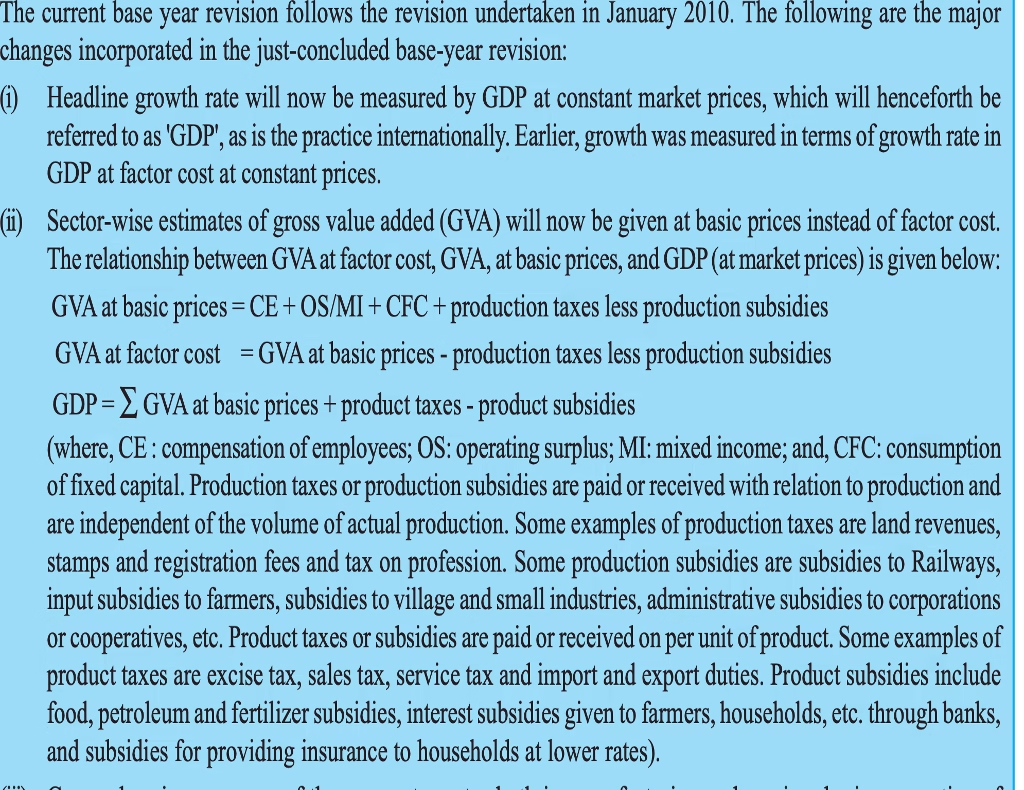

Gross Value Added Method of GDP calculation

In a major overhaul of the way India’s gross domestic product (GDP) is calculated, the Central Statistics Office (CSO) started measuring the country’s economic growth by gross value-added (GVA) at basic prices from 2015 onwards, replacing the practice of measuring it by GDP at factor cost. Here we look at the major difference between the old method of GDP calculation to new method of GDP calculation i.e. Gross Value Added Method.

Why new method was adopted by Central Statistical Office (CSO):

The new method was recommended by the United Nations System of National Accounts (SNA) in 2008 and will make India’s GDP growth numbers comparable with that of developed nations. The SNA describes a coherent, consistent and integrated set of measures in the context of internationally agreed concepts, definitions, classifications and accounting rules.

Methodological Changes: There are two specific changes adopted by the CSO. Those are:

- Gross Value Added (GVA) from different sectors will be calculated at basic prices.

- GDP of the country is to be estimated in terms of Market Price.

- What is Gross Value Added (GVA): GVA provides the rupee value of the amount of goods and services that have been produced, less the cost of all inputs and raw materials while producing these goods and services. There can be GVA for a firm, industry, sector or the entire economy. Hence, first we should calculate the GVA of each sector in a prescribed format. Here, the SNA and the new methodology adopted in India calculate sectoral GVA at basic prices.

When using production or income approaches to estimate national income are adopted, the contribution of a particular industry or sector to an economy is measured using GVA.

GVA: Gross value added (GVA) is the value addition done to a product resulting in the production of final product.

GDP: Gross Domestic Product (GDP) is the total value of products produced in the country.

While GDP gives a picture of whole economy, GVA gives pictures at enterprises, government and households levels. In other words, GDP is GVA of all enterprises, government and households.How to calculate Gross Value Added at basic prices: Under the old method, GDP was calculated at factor cost; now it will be done at basic prices. To understand the difference, let us look at it from the producers’ point of view.

For a producer, GVA at factor cost represents what he gets from the industrial activity.- Production taxes: Stamp duties, registration fees and property taxes etc.

- Production subsidies: subsidies to labour, capital and investment – called factors of production – such as apprentice subsidies and interest subsidies constitute.

Production subsidies are different from Product subsidies.

Product taxes and Product subsidies – Product taxes or subsidies are paid or received on per unit of the product.

Examples for product tax are excise duties, sales tax etc. Food, fertilizer and fuel subsidies which are provided per unit are product subsidies.For arriving at the new gross value added (GVA) at basic prices, production taxes, such as property tax, are added and subsidies are subtracted from GVA at factor cost. Put simply, GVA at basic price represents what accrues to the producer, before the product is sold.

GVA at basic prices = GVA at factor cost + Production Taxes – Production subsidies.

Why tax has to be added and subsidies have to be reduced? Taxes are out of the effort (production) of the producer. Actually, it is brought out of his income. On the other hand, subsidies are not his income, it is accrued from outside. Subsidies are not out of the contribution of the concerned firm. So, taxes to be added and subsidies should be reduced to estimate the GVA of the concerned firm/sector.

- GDP at Market Price: While the growth in the economy under the old series was gauged by the growth in GDP at factor cost, under the new series, is based on GDP at constant market prices — involving more adjustments to the above calculated GVA at basic prices. The first level of adjustment is to convert to market prices.

The price paid by the consumer is not the same as the revenue received by the producer. This is because of the taxes that are paid to the government in the form of indirect taxes. Similarly, the consumer may receive subsidies on food or petrol. GDP at market prices makes adjustment for any such subsidy or indirect tax — to arrive at GDP at market price, indirect taxes are added while subsidies are subtracted from GVA at basic price.

GDP at market price = GVA at basic price + Product taxes – Product subsidies.

- More Coverage: the larger the sample, the more accurate is the study. To measure anything in economics, we need data first. W.r.t this data there are two challenges:

First, that monetary value of all the activities of any corporate entity. Until now, the manufacturing data was compiled factory-wise. Now, activity at the enterprise-level is taken. What does this means?

Factory: A ‘factory’ is a manufacturing plant or may be a refilling plant or likewise.

Enterprise: An enterprise is a complete business which may involve buying and stockpiling raw materials (warehousing), manufacturing at factories, putting advertisements (marketing), selling (sales) etc.How does it makes a difference: In the given context what this means is that up till now government used only the manufacturing data to estimate the size of manufacturing portion of economy in the GDP, but now on they will use the data at the enterprise level meaning it will also include data on marketing, accounting, sales Etc. Meaning if you manufacture car for Rs 20,000 a unit but spend Rs 1,000 per unit to market and sell it. Then your contribution to the GDP will be Rs 21,000 per a unit of car.

Second, from how many number of corporate units we get that information. Earlier, for data on corporate activity, CSO relied on the data from the Annual Survey of Industries (ASI), which comprises over two lakh factories, was used to gauge activity in the manufacturing sector.

Annual Survey of Industries (ASI) is the main survey conducted by Central Statistics Office (CSO) Industrial Statistics (IS) wing. But in the latest method, to gauge activity in the manufacturing sector, annual accounts of companies filed with the Ministry of Corporate Affairs — MCA21 — has been used. This MCA21 include around five lakh companies, bringing in more companies from the unlisted and informal sectors. Thus more no of entities are under GDP calculation.

Which of the two measures is considered more appropriate gauge of the economy? A sector-wise breakdown provided by the GVA measure helps policy makers decide which sectors need incentives or stimulus and accordingly formulate sector specific policies. But GDP is a key measure when it comes to making cross-country analysis and comparing the incomes of different economies.

Net Domestic Product (NDP)

The net domestic product (NDP) is the gross domestic product (GDP) minus depreciation on a country’s capital goods. Net domestic product accounts for capital that has been consumed over the year in the form of housing, vehicle, or machinery depreciation. The depreciation accounted for is often referred to as “capital consumption allowance” and represents the amount of capital that would be needed to replace those depreciated assets.

If the country is not able to replace the capital stock lost through depreciation, then GDP will fall. In addition, a growing gap between GDP and NDP indicates increasing obsolescence of capital goods, while a narrowing gap means that the condition of capital stock in the country is improving. It reduces the value of capital, that is why it is separated from GDP to get NDP.

Uses of the concept of NDP:

- For domestic use only: to understand the historical situation of the loss sue to depreciation to the economy. Also used to understand and analyse the sectoral situation of depreciation in industry and trade in comparative periods.

- To show the achievements of the economy in the area of research and development, which have tried cutting the levels of depreciation in a historical time period.

Gross Vs Net in Economics

Gross refers to the whole of something, while net refers to a part of a whole following some sort of deduction.

- In economics, “gross” means before deductions, e.g., Gross Domestic Product (GDP) refers to the total market value of all final goods and services produced within a country, in a given period of time, usually a calendar year.

- In economics, “net” means After deductions, Net Domestic Product (NDP) refers to the Gross Domestic Product (GDP), minus depreciation on a country’s capital (economic) goods. (The NDP is thus, in effect, an estimate of how much the country has to spend to maintain its current GDP)

The value of output and value-added calculated above is a gross measure, because when goods are sold out in the market these include all type of costs. During production process fixed capital assets like machines, building etc. get depreciated and their value goes down. This is known as normal wear and tear of machinery or consumption of fixed capital or depreciation.

So every production unit makes provision for depreciation. When it is included in value, of output and value added, these are called Gross Value of output and Gross Value added respectively. If depreciation is not included in value of output and value added these are called Net Value of output and net value added respectively.

- Net Value of output = Gross Value of output – Depreciation

- Net Value added = Gross Value added – Depreciation

Gross National Product (GNP)

Gross national product (GNP) is the market value of all the products and services produced in one year by labour and property supplied by the citizens of a country.

Unlike gross domestic product (GDP), which defines production based on the geographical location of production, GNP indicates production based on location of ownership.

GNP includes income earned by citizens and companies of the particular country who are situated abroad, but does not include income earned by foreigners within the country.

GNP is an economic statistic that is equal to GDP plus any income earned by residents from overseas investments minus income earned within the domestic economy by overseas residents.

GNP Formula

The formula to calculate the components of GNP is:

Y = C + I + G + NX + Z.

GNP = GDP + Net factor income from abroad

That stands for GNP = Consumption + Investment + Government + X (net exports, or imports minus exports) + Z (net income earned by domestic residents from overseas investments – net income earned by foreign residents from domestic investments.)

Example of GNP

If a Japanese multinational produces cars in the UK. This production will be counted towards UK GDP. However, if the Japanese firm sends £50m in profits back to shareholders in Japan. Then this outflow of profit is subtracted from GNP of UK. UK nationals don’t benefit from this profit.

Use of GNP:

GNP is the “national income” according to which IMF ranks nations based on PPP or Purchasing Power Parity. [India ranked 3rd after USA, and China] It is indicative of the qualitative as well as quantitative aspect of the economy.

The concept of domestic territory (Economic territory) is different from the geographical or political territory of a country.

Domestic territory of a country includes the following

- Political frontiers of the country including its territorial waters.

- Ships and aircrafts operated by the normal residents of the country between two or more countries for example, Air India’s services between different countries.

- Fishing vessels, oil and natural gas rigs and floating platforms operated by the residents of the country in the international waters or engaged in extraction in areas where the country has exclusive rights of operation.

- Embassies, consulates and military establishments of the country located in other countries, for example, Indian embassy in U.S.A., Japan etc. It excludes all embassies, consulates and military establishments of other countries and offices of international organizations located in India.

Thus, domestic territory may be defined as the political frontiers of the country including its territorial waters, ships, aircrafts, fishing vessels operated by the normal residents of the country, embassies and consulates located abroad etc.

Normal Resident

The term normal resident is different from the term nationals (citizens). A normal resident is a person who ordinarily resides in a country and whose centre of economic interest also lies in that particular country. Normal residents include both nationals (such as Indians living in India) and foreigners (non-nationals living in India).

For example, Nepalese living in India for more than one year and performing economic activities of production, consumption and investment in India, will be treated as normal residents of India. On the contrary, Indian citizens, living abroad (say in USA) for more than one year and performing their basic economic activities there, will be treated as normal resident of that country where they normally reside. They will be considered as residents of India (NRIs).

Net National Product (NNP)

Net national product (NNP) is gross national product (GNP) minus depreciation. Depreciation describes the devaluation of fixed capital through wear and tear associated with its use in productive activities.

NNP = Gross National Product – Depreciation

NNP or Net National Product is the purest form of Income. It is generally referred as National Income or NI.

We can find the per capita income of a country if we know the NNP and total population.

e.g. Per capita income = (NNP/ total Population)

Domestic Income Vs National Income

The sum total of value added by all production units within domestic territory of a country is called domestic product. Both residents and non-residents render factor services to these units.

Therefore, the income generated in these units is shared by both the residents and non-residents as their factor income. To get contribution of only normal residents (or their factor income earned within the domestic territory) we have to deduct the factor payments made to the non-residents.

These factor payments are known as factor payments made to the rest of the world. The residents, in addition to their factor services to the production units located in the economic territory of a country, also provide factor services to the production units outside the economic territory i.e., to the rest of the world (ROW). In return for these services they receive factor incomes from the rest of the world.

Let’s understand with examples

Included in National Income, but not in Domestic Income:

- Salary received by an Indian employee working in the British Embassy in India. It will be included in the national income as he is a resident of India. However, such an income will not be included in India’s domestic income as the British Embassy is not a part of the domestic territory of India.

- Profits of a branch of State Bank of India (SBI) in Australia. It will be included in the national income as it is a part of the factor income from abroad. However, it will not be included in India’s domestic income as the SBI branch in Australia is not a part of the domestic territory of India. Included in Domestic Income.

but not in National Income:

- Rent received by a company in India, which is owned by a non-resident. It will be included in the domestic income as the rent is received within the domestic territory of India. However, it will not be included in the national income as it is a part of the factor income paid abroad.

- Profits earned by a branch of a foreign bank in India. It will be included in the domestic income as these profits are earned within the domestic territory of India. However, it will not be included in the national income as it is a part of the factor income paid abroad (Foreign Bank is not a resident of India).

Thus, National income is the sum total of factor incomes earned by the normal residents of a country within and outside the economic territory.

National Income = Domestic Income + Factor income received from ROW – Factor payments made to ROW.

Net Factor Income from ROW: It is the difference between factor income’s received from ROW and factor payments made to ROW.

National Income/Product = Domestic Income/product + Net factor income from abroad

NNP at Factor Cost

(Net National Product at Factor Cost) is the net money value of all the goods and services produces by normal residents of a country. It includes income of Indian citizens whether living in or outside India. It is net of the national income which means, it do not include depreciation. Moreover, it is at factor cost, so it also don’t include NIT (net indirect taxes). It is country’s national income.

NNP at factor cost (or) National income = NNP at market price – (Indirect Taxes – Subsidy) = NNPMP – Indirect Tax + Subsidy.

Indirect taxes are those taxes which are levied by the government on sales and production and also on imports of the commodities in the form of sales tax, excise duties, custom duties etc. These taxes increase the market price of the commodities.

Subsidies

Sometimes, Government gives financial help to the production units for selling their product at lower prices fixed by the government. Such help is given in case of those selected commodities whose production the Government wants to encourage. If we deduct these subsidies from indirect taxes, we get net indirect taxes.

Net Indirect Taxes: It is the difference between indirect tax and subsidy.

Net Indirect Tax = Indirect Tax – Subsidy

Personal income and Disposable income

- Income from Domestic product accruing to Private Sector: This refer to that part of the domestic product at factor cost which accrues to the private sector of the economy. It is estimated as: Income from domestic product accruing to government, savings of non-department enterprises.

- Private Income: It refers to the income earned by the individuals from whatever source within the domestic territory of the county and aboard. It is obtained as follows:

Private Income = Income from domestic sources accruing to private sector – NFIA + Net current transfer from the rest of the word + current transfers from the government + interest on National Debit.

- Personal Income: This is the aggregate money payments received by the individual. For example, corporate income taxes are a part of national income, but they are not received by the individuals. So, to arrive at personal income corporate Taxes must be subtracted from national Income. Similarly, social security contributions, undistributed corporate profits etc are reduced from the national Income.

Then, there are some incomes received which are not currently earned (e.g. transfer payments, which include old -age pensions, unemployment relief, other relief payments, interest payments on the public debt. Etc.) So, we arrive at personal Income with following formula:

Personal income = National Income + social contributions – Corporate Income taxes – Undistributed Corporate Profits + Transfer payments.

- Disposable Income (DI): The personal income is the income of an individual. He/she pays personal taxes, property taxes etc. and after that whatever left to him or her is Disposable Income.

Disposable Income = Personal Income – Personal taxes.

There is another formula: Disposable Income = Consumption + Saving.

What are the problems in calculating National Income

Measuring of economy on GDP standards consist some drawbacks.

- Double Counting Problem: Including the price of intermediate goods individually and with final product.

- Self-doing activities: Unrecorded economy in personal activities like the duties performed by one-self, housewives etc. are not included in the GDP.

- Illegal Economy: The economy which can be shown incorrectly due to corruption, bribery and drugs business.

- Statistical Errors: People measuring the economy not performing their duties with honesty or the standard they are using are not current to measure the accurate value of GDP.

- Pollution Factor: Pollution factor can’t be included in GDP.

- Facilities and living standards: Facilities and living standards improvement can’t be indicated by GDP, to show whether the people of the country are worst off or well off.

- Quality Improvements: As the time passes quality improve with speed as compared to the price, GDP can only ure the price as value but not quality.

- Transfer Payments are not considered as part of GDP.

Nominal and Real GDP

Inflation can distort economic variables like GDP, so we have two versions of GDP: One is corrected for inflation, the other is not.

- Nominal GDP values output using current prices. It is not corrected for inflation.

- Real GDP values output using the prices of a base year. Real GDP is corrected for inflation.

Real GDP is better as compared to Nominal GDP because of following reasons:

- Real GDP helps in determining the effect of increased production of goods and services as it is affected by change in physical output only. On the other hand, Nominal GDP can increase even without any increase in physical output as it is affected by change in prices also.

- Real GDP is a better measure to make periodic comparison in the physical output of goods and services over different years.

- Real GDP facilitates international comparison of economic performance across the countries.

What is Base Year?

A base year is the year used for comparison in the measure of a business activity or economic index. In the base year all the economic activities are equated to 100 percent based on the market price of those activities in that year. Under that 100%, each activity is given a certain percentage based on the importance of that activity in terms of contribution to GDP.

Why to change base year regularly: Take the example, suppose India’s GDP is Rs. 1000 and base year is 2000. Now, in 2015, many sectors such as IT, e-commerce, mobile telephony etc contributes to our economy, which were not present in 2000.

Thus, India might be showing wrong GDP figures, since majority of economic activities driving sectors are not represented in Rs. 1000. So, our govt. decides to change the base year to 2010. The revised base year will lead to all such sectors coming into play, and the GDP number will increase as the total output from these sectors will be added, which was not the case in 2000 base year.

Who advises the changing the Base Year: The National Statistical Commission, which had advised to revise the base year of all economic indices every five years. The new base year has been selected in line with the latest quinquennial round of employment-unemployment survey.

What are constant prices and current prices? The estimates at the prevailing prices of the current year are termed as “current prices”, while those prepared at the base year are termed as “constant prices” or “base year prices”.

Economic Growth

The term economic growth is defined as the process whereby the country’s real national and per capita income increases over a long period of time. This definition of economic growth consists of the following features:

- Economic Growth implies a process of increase in National Income and Per-Capita Income.

- Economic Growth is measured by increase in real National Income and not just the increase in money income or the nominal national income.

- Increase in Real Income should be Over a Long Period.

- Increase in income should be based on Increase in Productive Capacity.

Calculating Economic Growth:

The most common tool to measure economic growth is GDP, which is basically sum total of goods and services produced in the country.

Economic Growth = ((Real GDPn – Real GDPn-1) / Real GDPn-1) x 100

GDP Deflator

The GDP deflator, also called implicit price deflator, is a measure of inflation. Simply put, it is the ratio of the value of goods and services an economy produces in a particular year at current prices to that at prices prevailing during any other reference (base) year.

This ratio basically shows to what extent an increase in GDP or gross value added (GVA) in an economy has happened on account of higher prices, rather than increased output. Since the deflator covers the entire range of goods and services produced in the economy as against the limited commodity baskets for the wholesale or consumer price indices it is seen as a more comprehensive measure of inflation.

The GDP deflator measures price changes in the economy as a whole, including business investment, government spending and net exports (exports minus imports).

The Gross Domestic Product (GDP) deflator is a measure of general price inflation. It is calculated by dividing nominal GDP by real GDP and then multiplying by 100.

- Nominal GDP is the market value of goods and services produced in an economy, unadjusted for inflation (It is the GDP measured at current prices).

- Real GDP is nominal GDP, adjusted for inflation to reflect changes in real output (It is the GDP measured at constant prices).

GDP Deflator = (Nominal GDP/Real GDP) × 100

Importance of GDP Deflator

- There are other measures of inflation too like Consumer Price Index (CPI) and Wholesale Price Index (or WPI); however GDP deflator is a much broader and comprehensive measure. Since Gross Domestic Product is an aggregate measure of production, being the sum of all final uses of goods and services (less imports), GDP deflator reflects the prices of all domestically produced goods and services in the economy whereas, other measures like CPI and WPI are based on a limited basket of goods and services, thereby not representing the entire economy (the basket of goods is changed to accommodate changes in consumption patterns, but after a considerable period of time).

- Another important distinction is that the basket of WPI (at present) has no representation of services sector. The GDP deflator also includes the prices of investment goods, government services and exports, and excludes the price of imports. Changes in consumption patterns or the introduction of new goods and services or structural transformation are automatically reflected in the deflator which is not the case with other inflation measures.

- However WPI and CPI are available on monthly basis whereas deflator comes with a lag (yearly or quarterly, after quarterly GDP data is released). Hence, monthly change in inflation cannot be tracked using GDP deflator, limiting its usefulness. Ministry of Statistics and Programme Implementation (MOSPI) comes out with GDP deflator in National Accounts Statistics as price indices. The base of the GDP deflator is revised when base of GDP series is changed. The latest available GDP deflator series with 2004-05 The rate of inflation is calculated by using the basic percentage change formula with either two CPI numbers or two GDP deflator numbers its usefulness.

Ministry of Statistics and Programme Implementation (MOSPI) comes out with GDP deflator in National Accounts Statistics as price indices. The base of the GDP deflator is revised when base of GDP series is changed. The latest available GDP deflator series with 2004-05.

The rate of inflation is calculated by using the basic percentage change formula with either two CPI numbers or two GDP deflator numbers.

Green GDP

The green gross domestic product (Green GDP) is an index of economic growth with the environmental consequences of that growth factored into a country’s conventional GDP. It’s a measure of how a country is prepared for sustainable economic development. Green GDP measures GDP growth along with the environmental consequences of that growth factored in.

The Green GDP figure accounts for the environmental costs of depletion and degradation of natural resources into the country’s economic growth figures.

Why Green GDP?

The major arguments in favour of the Green GDP system that have been cited by researchers and have been accepted by many countries are as follows:

Interrelationship between market and nature: The heart of the Green GDP approach lies in the belief that nature and market are not mutually exclusive variables. In fact both of them have a deep interconnected relationship. Natural resources fuel market growth and excessive market growth has the potential to destroy natural resources. Hence, there is a need to actively manage this relationship between these variables. Also, since measurement is the first step towards management, there is an immediate need for a metric which can measure the relationship between them and summarize it.

Comparison across peers and periods: Countries like China have also stated that Green GDP can be used to make comparisons for the same country across various years or it could be used to compare a country’s environmental status with that of another country. The idea is to include reports like depletion analysis in the GDP reports. This will enable analysts to predict even more accurately how the growth of those economies will be affected in the future.

Accountability: Last but not the least it will bring some accountability to government’s worldwide. It has become a common practice to ensure that the market system grows while the natural system perishes.

Challenges Facing Green GDP

- The biggest challenge facing the Green GDP is that of realistic accounting. Since we are essentially measuring the intangible, it is very difficult to estimate the monetary values associated with them. The Green GDP system is not perfect. However, it is developing. Many scholars and researchers are working towards a solution wherein Green GDP can become more pragmatic and realistic.

- The idea is to ensure that the flaws of the GDP system are not replaced by another flawed system. The process might take time but seems to be on the right track.

Who computes GDP in India?

The Central Statistics Office (CSO) calculates India’s GDP. It comes under the Ministry of Statistics and Program Implementation. It gathers data and maintains statistical records. Among its various duties, it performs periodic surveys of industries and compiles indexes like Index of Industrial Production (IIP), Consumer Price Index (CPI), Wholesale Price Index (WPI), etc, to calculate GDP and other statistics. It co-ordinates with various state and central government agencies and departments to collect the data. For example, the Industrial Statistics Unit of the Department of Industrial Policy and Promotion under the Ministry of Commerce and Industry gives data for IIP.

Methods of calculating Indian GDP:

There are mainly four methods to calculate GDP in India:

- At Factor Cost – based on economic activity

- At Market Prices – based on expenditure

- Nominal GDP – using current market price

- Real GDP – inflation adjusted

Note: All the four are released, but the factor cost is the number reported by the newspaper.

Note: India’s GDP is calculated quarterly and annually. The reports are released at a two month gap

NSO & NSSO

The Ministry of Statistics & Programme Implementation (MoSPI), Government of India is the nodal agency for planning and facilitating the integrated development of the statistical system in the country, and to lay down norms & standards in the field of official statistics, evolving concepts, definitions, classification and methodologies of data collection, processing and release of results.

The Ministry has two wings, one relating to Statistics and the other is Programme Implementation. The Statistics Wing called National Statistical Organisation (NSO) consists of:

National Statistical Office (NSO)

- It is responsible for coordination statistical activities in the country and for evolving and maintaining statistical standards.

- Its activities include compilation of National Accounts; conduct of Annual Survey of Industries and Economic Censuses, compilation of Index of Industrial Production, as well as Consumer Price Indices

- It also deals with various social statistics training, international cooperation, Industrial Classification etc.

National Sample Survey Office (NSSO)

Formerly known as National Sample Survey Organisation, NSSO is responsible for conduct of large scale sample surveys in diverse fields on All India basis. Primary data are collected through nation-wide household surveys on various socio-economic subjects, Annual Survey of Industries (ASI), etc. Besides these surveys, NSSO collects data on rural and urban prices and plays a significant role in the improvement of crop statistics through supervision of the area enumeration and crop estimation surveys of the State agencies. It also maintains a frame of urban area units for use in sample surveys in urban areas.

- It is responsible for conducting socio-of economic surveys.

- The surveys on Consumer Expenditure, Employment–Unemployment, Social Consumption (Health, Education etc.),Manufacturing Enterprises, Service sector Enterprises are carried out once in 5years by them.

- The survey of Land and Livestock Holding and Debt and Investment are carried out once in 10 years.