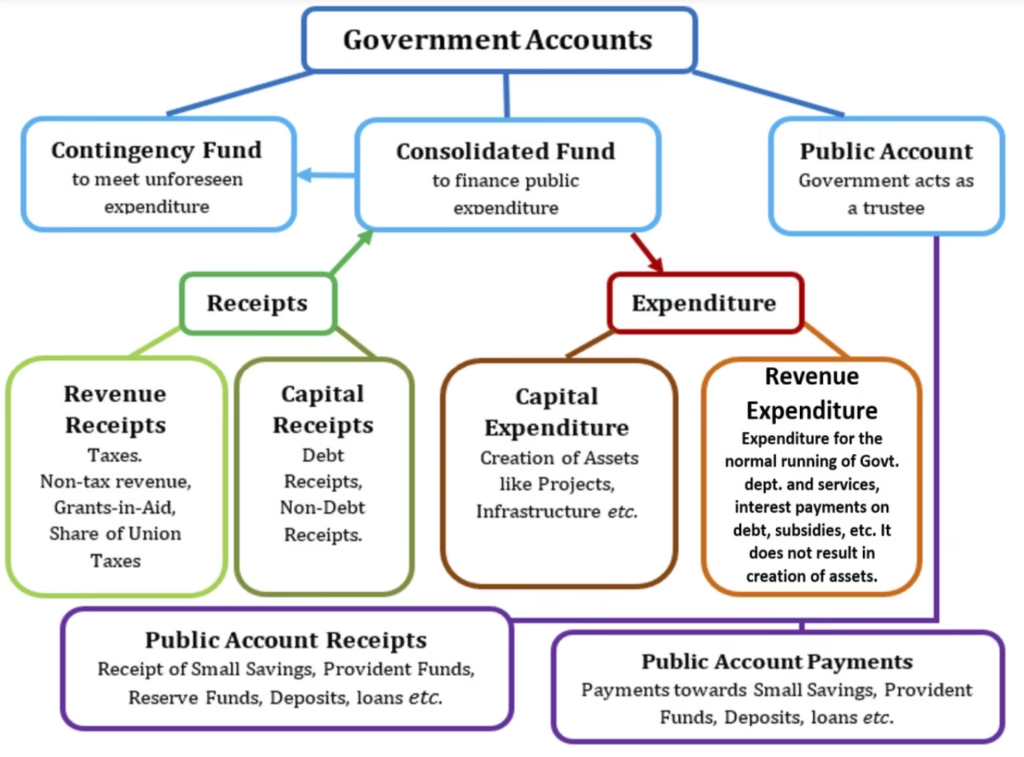

The Government of India’s accounts are organized into three main divisions:

- Consolidated Fund(Article 266)

- Contingency Fund(Article 267)

- Public Account(Article 266)

The financial framework of the Central Government of India is structured around above three primary funds. Each of these funds serves distinct purposes and is essential for the fiscal management of the country.

This division allow the Union Government to maintain transparency, accountability, and efficient utilization of public resources in pursuing its developmental and administrative objectives.

Consolidated Fund of India

Sources of Revenue:

- All revenues received by the Government of India,

- Loans raised by the Government by the issue of treasury bills, loans or ways and means of advances, and

- Money received by the government in repayment of loans.

Expenditures:

All the legally authorized payments on behalf of the Government of India are made out of this fund.

The government needs parliamentary approval to withdraw money from this fund.

Expenditure Charged vs. Expenditure Made from Consolidated Fund

Charged Expenditures

Non-votable charges are called charged expenditures.

Voting doesn’t takes place for this amount which is spent from the Consolidated Fund of India. Parliamentary approval is not needed.

These are paid whether or not the budget is passed.

Emoluments, allowances and expenditure of the President and his office, salary and allowances of chairman, Deputy chairman of Rajya Sabha, Speaker, Supreme Court judges, CAG and Deputy Speaker of the Lok Sabha come under this expenditure.

Another example of charged expenditure is debt charges of the government.

These are not voted because these payments are deemed guaranteed by the state.

Even though voting does not take place, discussion on these can take place in both the Houses.

Made out of Consolidated Fund of India

This is the actual budget.

The expenditures in the budget are actually in the form of Demand for Grants.

The demands for grants are presented to the Lok Sabha along with the Annual Financial Statement. Generally, one Demand for Grant is presented for each Ministry or Department.

Contingency Fund of India

Sources of Revenue:

Amounts determined as per the Contingency Fund of India Act, 1950 are credited to the Contingency Fund of India, from time to time from Consolidated fund of India.

Its corpus is Rs. 30,000 crores. It is in the nature of an imprest (money maintained for a specific purpose).

Expenditures:

The Secretary of, Finance Ministry holds this fund on behalf of the President of India.

This fund is used to meet unexpected or unforeseen expenditure.

The Contingency Fund of India is operated by Executive Action, pending its authorization by Parliament.

Public Account of India

Sources of Revenue:

- Provident Fund Deposits,

- Judicial Deposits,

- Savings Bank Deposits,

- Departmental Deposits,

- Remittances, etc.

Expenditures:

- The Public Account of India includes funds that the government holds on behalf of other entities, including individuals, institutions, and other governments.

- These funds are separate from the government’s revenues and are not available for general governmental expenditure.

- Thus, expenditures from the Public Account of India involve disbursements made to return funds to their rightful owners or to meet specific obligations.

- They are mostly in the nature of banking transactions.

- The government does not need permission to take advances from this account.

Public Account of India also includes

National Investment Fund (money earned from disinvestment):

Government had constituted the National Investment Fund (NIF) in November, 2005 into which the proceeds from disinvestment of Central Public Sector Enterprises were to be channelized.

The corpus of NIF was to be of a permanent nature and NIF was to be professionally managed to provide sustainable returns to the Government, without depleting the corpus.Selected Public Sector Mutual Funds, namely UTI Asset Management Company Ltd., SBI Funds Management Private Ltd. and LIC Mutual Fund Asset Management Company Ltd. were entrusted with the management of the NIF corpus.

As per this Scheme, 75% of the annual income of the NIF was to be used for financing selected social sector schemes which promote education, health and employment. The residual 25% of the annual income of NIF was to be used to meet the capital investment requirements of profitable and revivable PSUs.

National Calamity & Contingency Fund (NCCF) (for Disaster Management):

The National Calamity Contingency Fund (NCCF) was renamed the National Disaster Response Fund (NDRF) in 2005 by the Disaster Management Act (DMA).

The NDRF is a fund managed by the Central Government to help with emergency relief, disaster response, and rehabilitation in the event of a disaster.

Summary of Government of India’s Accounts

| Fund | Consolidated Fund of India(Art. 266(1)) | Contingency Fund of India(Art. 267(1)) | Provident Fund(Art. 266(2)) |

|---|---|---|---|

| Source of Revenue | Taxes and non-tax revenue | Fixed corpus of Rs. 30,000 crore | Public money other than those under consolidated fund |

| Expenditure | All expenditure | Unforeseen expenditure | Public money other than those under consolidated fund |

| Parliamentary Authorisation | Required prior to expenditure | Required after the expenditure | Not required |