Net demand and time liabilities(NDTL) measure a company’s liquidity. It measures the balance between what a company owes in the short term (e.g. bills and loans) and what it owns that can be converted into cash quickly.

Assets and Liabilities

Assets are the items that you own and has the potential to generate income.

Liabilities are what you owe to others.

In case of banks the deposits accepted are liabilities and loans disbursed are assets.

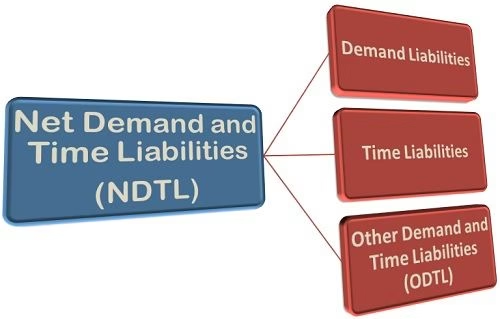

Demand Liabilities: These are the most immediate obligations for a bank, as they need to be readily available for depositors on demand. Banks must maintain sufficient cash reserves and a high level of liquidity to meet these demands.

Examples: Current accounts, savings accounts with immediate withdrawal access, demand drafts, outstanding checks, and accrued expenses payable within a short period.

Time Liabilities: These liabilities provide a more stable funding source for the bank as they have a fixed maturity date. Banks can invest these funds in longer-term assets like loans and earn interest.

Examples: Fixed deposits, recurring deposits, certificates of deposit with specific maturity dates, and long-term borrowings.

Other Demand and Time Liabilities: This category can encompass a variety of liabilities with varying withdrawal terms and maturities, making it essential to carefully analyse each type to understand its impact on liquidity and risk management.

Examples: Notice deposits, savings accounts with limited withdrawal windows, and special term deposits with specific requirements.

Liability to Others: refers to funds a bank owes to other banks or financial institutions.

Examples: interbank deposits, interbank borrowings, correspondent banking relationships, repos and reverse repos, clearing and settlement obligations, etc.

NDTL = (Demand Liabilities + Time Liabilities + Other Demand and Time Liabilities + Liability to Others) – Assets with the Banking System

Example:

- Demand Liabilities: Rs. 60 million

- Time Liabilities: Rs. 40 million

- Other Demand and Time Liabilities: Rs. 10 million

- Liability to Others: Rs. 5 million

- Assets with the Banking System: Rs. 100 million

=> NDTL = (Rs. 60 million + Rs. 40 million + Rs. 10 million + Rs. 5 million) – Rs. 100 million

=> NDTL = Rs. 115 million – Rs. 100 million

=> NDTL = Rs. 15 million

What does NDTL have to do with SLR?

Suppose the NDTL for a bank is Rs 10 Lakh, does that mean that the bank can lend out the entire 10 Lakh in the form of loans?

No. Because if that happens, then the bank will be left with no liquid money or buffer.

Every business requires cash liquidity and to regulate that in case of banks, is the role of the Reserve Bank of India. The RBI mandates that a portion of this Rs 10 Lakh needs to be kept with the bank but in the form of liquid assets.

Liquid assets are assets that are either cash or can be converted into cash easily, for example- Cash, Gold or Government securities etc. This percentage is called the Statutory Liquidity Ratio (SLR).

In our example, if the RBI mandates the banks to maintain an SLR of 20%, then the bank will keep Rs 2 Lakh in liquid assets and will be able to loan out only the remaining Rs 8 Lakh. The amount of R 2 Lakh is like a safety net for the bank in case any crisis strikes.

The example stated above is for illustrative purposes only.

SLR= (Liquid assets mandated by the RBI/ NDTL)%