Current Affairs – 07/12/24, consists of the news and views from Mint(Hindustan Times) and Indian Express.

Current Affairs – 07/12/24 I Source: Mint

MPC opens ₹1.16 tn cash tap as growth view dims

The Reserve Bank of India’s monetary policy committee (MPC) kept both policy rates and its stance unchanged on Friday, but sharply lowered its growth estimate for the full year to 6.6% from 7.2% earlier.

Four out of the six-member rate-setting panel voted to keep repo unchanged at 6.5%, The MPC unanimously voted to keep the stance unchanged at neutral.

A basis point is one-hundredth of a percent.

RBI also announced measures to support rupee liquidity in the system. It cut the cash reserve ratio (CRR) by 50 basis points for the first time in four years to ease monetary conditions as economic growth slows.

CRR is the percentage of a bank’s total deposits that it is required to maintain in liquid cash with RBI as a reserve.

The RBI also announced a temporary 150bps hike in deposit rate ceiling for non-resident Indians (NRIs), applicable until end March 2025, to attract more capital flows.

“The MPC has adopted a prudent and cautious approach in this meeting to wait for better visibility on the growth and inflation outlook. At such a critical juncture, prudence, practicality and timing of decisions become even more critical,” Das said.

The spike in inflation in October and the expectation of an elevated print in November also caused the MPC to revise its FY25 CPI projection to 4.8% for FY24-25 from 4.5% earlier. While the MPC expects a reversal in vegetable prices, it flagged risks of rising input costs.

The decision to normalize CRR to 4% of net demand and time liabilities (NDTL) in two equal tranches (of 25 bps each) on 14 December and 28 December will release ₹1.16 trillion of liquidity in the system. Liquidity is expected to remain tight this month on tax-related outflows and increase in currency in circulation and forex outflows

With inflation coming off and growth expected to be lower than RBI’s revised estimate in the second half, analysts expect a policy pivot from February.

“Going forward, as the worst of quarterly growth reading and peak inflation seem to be behind us, we expect the MPC to derive comfort from the same and commence rate easing from February 2025, cutting the policy repo rate by 25bp, as inflation moderates closer to target and growth may still fall short of the MPC’s forecast,” said Barclays.

Also Read: Latest MPC Review

RBI hikes rate cap on banks’ FCNR deposits

The Reserve Bank of India’s decision to increase the interest rate ceilings on Foreign Currency Non-Resident (Banks) Account or FCNR(B) deposits is aimed at supporting foreign inflows into the country, as the domestic currency battled a slump against the dollar.

FCNR (B) is a deposit scheme that allows non-resident Indians (NRIs), persons of Indian origin (PIOs) and overseas citizens of India (OCIs) to invest their foreign earnings in Indian fixed deposit accounts. Such deposits can be made in multiple currencies such as the US dollar, British pound sterling, Australian dollar, euro and Canadian dollar.

“The move to incentivize the FCNR borrowings (by raising interest rate ceiling) reflects the fact RBI would be weighing the cost of heavy FX (foreign exchange) intervention in the past two months amidst FPI (foreign portfolio investor) outflows and limited conviction on steady inflows ahead,” .

“This is clearly a tacit attempt to tap other sources of foreign capital flows, which could give RBI some breathing room and lower its need for FX intervention,” she added, pegging the central bank’s FX market intervention in the past two months at $35-40 billion in the spot and forwards market and at $60 billion in the non-deliverable forwards (NDF) market.

In its Statement on Developmental and Regulatory Policies, released alongside the monetary policy statement on Friday, the RBI increased the interest rate ceilings on FCNR(B) deposits of 1-5 years’ maturity by up to 150 basis points (bps).

Banks can now raise these deposits at the overnight alternative reference (ARR) plus 400 bps for deposits of 1-3 years, and at ARR plus 500 bps for deposits of 3-5 years. Earlier, rates on FCNR(B) deposits were subject to ceilings of overnight ARR for the respective currency/swap, plus 250 bps for deposits of 1-3 years and overnight ARR plus 350 bps for deposits of 3-5 years.

This is the second such recent instance of the central bank relaxing FCNR(B) limits. Prior to this, in July 2022, RBI had allowed banks to raise new FCNR(B) and non-resident external (NRE) deposits irrespective of the ceilings on interest rates between 7 July 2022 and 31 October 2022. RBI had then also exempted FCNR(B) and NRE deposits, accrued between 1 July 2022 and 4 November 2022, from the computation of net demand and time liabilities (NDTL) for maintenance of the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR).

CRR is the minimum reserves that banks need to park with the central bank in cash or as deposits. SLR refers to the minimum percentage of deposits that a commercial bank must keep in the form of liquid assets.

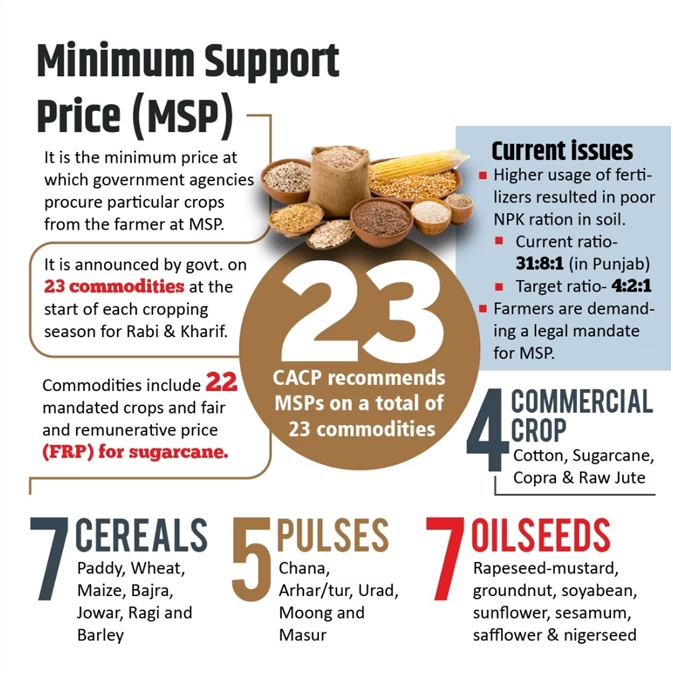

Centre to buy all crops at MSP

The Narendra Modi government has fixed minimum support prices (MSPs) of crops to give at least 50% returns and will purchase all farm produce at these rates, Union agriculture minister Shivraj Singh Chouhan said in the Rajya Sabha on Friday, as farmers marched to the Capital to demand legally guaranteed prices.

Union agriculture minister Shivraj Singh Chouhan said we will increase production, reduce the cost of production, give a fair price for the production, if there is loss in the crop, it will be compensated under the Pradhan Mantri Fasal Bima Yojana (a state-run farm insurance scheme).”

The Centre fixes MSP for 23 essential crops to protect producers against any distress selling, taking into account the cost of production. But it buys only rice and wheat in sufficient quantities at that price. Farmers have demanded enforceable MSPs for all essential crops.

The farmers are demanding a law guaranteeing minimum crop prices, renewing a movement in 2021 that saw the government withdraw three agricultural laws opposed by farmers.

Q3 will make up for poll-induced growth slowdown: FM Sitharaman

India’s economic growth decelerated in the September quarter because of this year’s general elections, and is not a systemic issue, finance minister Nirmala Sitharaman said on Friday, exuding confidence that growth in December quarter would make up for the lost momentum.

Sitharaman, however, conceded that the plateauing consumption demand in developed economies was a matter of concern for India’s exports.

Sitharaman said spending slows down during the first quarter of election years, as central and state administrations focus on the electoral process. This is reflected in the second-quarter growth numbers.

The Indian economy expanded at 5.4% in the September quarter, from 6.7% in June quarter and 8.2% in the September quarter of FY24. China’s economy grew 4.6% while the US grew 2.8% in the September quarter.

The FM said the government was aware of factors that may influence India’s consumption demand. “I think India, not just for this year, but for the next year and the year after that has very good chances and opportunities to be the fastest-growing economy.”

The minister, however, admitted that the concern about the impact of global demand slowdown on countries such as India was “legitimate”. In October, International Monetary Fund maintained its 3.2% forecast for global economic growth both for 2024 and 2025, as growth looked stable but underwhelming, with the balance of risks tilted to the downside. “If there is a plateauing demand in the developed nations countries, it is a matter of concern,” she said. Climate-related concerns also weigh heavily on India, especially on farm produce, she added.

Saturating global demand for goods—whether in labour-intensive export sectors like textiles or more sophisticated products—poses a challenge as it removes marginal additional support to domestic manufacturing from the export opportunity, the minister said.

Economic Survey 2023-24 had conservatively projected real GDP growth for FY25 of 6.5-7% with risks evenly balanced. Chief economic advisor V. Anantha Nageswaran said the 5.4% expansion was disappointing but not alarming.

Note

In order to ensure the aspirant would enjoy reading the complete article, as reading the crux or gist might help you to remember and look at the big picture.

we are trying to share the original article with small tweaks, without any loss of information.

In order to avoid redundancy, the news which is common in both papers is reported only once, to save your time.