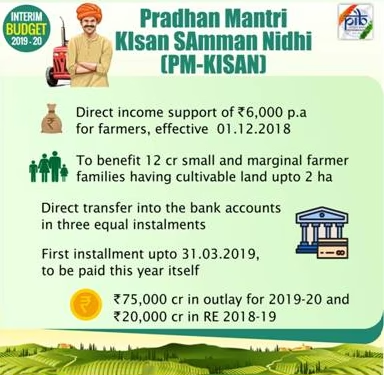

PM Kisan is a Central Sector scheme with 100% funding from Government of India.

It has become operational from 1.12.2018.

Definition of family for the scheme is husband, wife and minor children.

The fund will be directly transferred to the bank accounts of the beneficiaries.

There are various Exclusion Categories for the scheme.

What are the objectives of PM-Kisan scheme?

- Financial support

- Reduce dependence on moneylenders

- Enable farmers to continue farming

The PM-KISAN scheme aims to supplement the financial needs of the Small and Marginal farmers (SMFs) in procuring various inputs to ensure proper crop health and appropriate yields, commensurate with the anticipated farm income at the end of the each crop cycle.

This would also protect them from falling in the clutches of moneylenders for meeting such expenses and ensure their continuance in the farming activities.

Who is eligible for the PM-Kisan scheme?

All small and marginal landholders except those farmers as per the below exclusion criteria.

Who are ineligible or excluded for the PM-Kisan scheme?

The following categories of beneificiaries of higher economic status shall not be elligible for benefit under the scheme.

- All Institutional Land holders.

- Farmer families which belong to one or more of the following categories:.

- Former and present holders of constitutional posts

- Former and present Ministers/ State Ministers and former/present Members of LokSabha/ RajyaSabha/ State Legislative Assemblies/ State Legislative Councils,former and present Mayors of Municipal Corporations, former and present Chairpersons of District Panchayats.

- All serving or retired officers and employees of Central/ State Government Ministries /Offices/Departments and its field units Central or State PSEs and Attached offices /Autonomous Institutions under Government as well as regular employees of the Local Bodies

(Excluding Multi Tasking Staff /Class IV/Group D employees) - All superannuated/retired pensioners whose monthly pension is Rs.10,000/-or more

(Excluding Multi Tasking Staff / Class IV/Group D employees) of above category - All Persons who paid Income Tax in last assessment year

What issues are associated with the PM-Kisan scheme?

There has been lot of reports that ineligible farmers are receiving the monetary benefit.

Eg: 60,000 ‘ineligible’ beneficiaries in Kerala under PM Kisan Samman Nidhi, shows data.

Resulting in huge burden on government.

Most of the tillers being tenant or share croppers, and lack of proper documents resulting in excluding them.

In fact the landlords are benefitting in spite of land being cultivated by a share cropper or tenant farmer.

How does the PM-Kisan scheme benefit farmers?

Supplements farmers income.

It helps in reducing the dependency of framers on money lenders.

Ensures farmers don’t fall in debt trap.

Reduce farm suicides due to high indebtedness.

Contain migration as most of small and marginal farmers no longer thinks agriculture is remunerative.

What initiatives has the government taken to ensure the financial security of farmers?

Along with PM Kisan samman nidhi, the other initiatives include:

Pradhan Mantri Fasal Bima Yojna

- To stabilize the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure the flow of credit to the agriculture sector.

Agriculture interest subvention scheme: Farmers receive short term credit at 7% with an upper limit of Rs. 3.00 lakh on the principal amount. The policy came into force with effect from Kharif 2006-07.

Pradhan Mantri Kisan Maan Dhan Yojana (PM-KMY) – Provides a minimum fixed pension of Rs. 3,000 to eligible SMFs when they turn 60 years old.

“What measures should be implemented to promote the growth of the Indian agriculture sector?”