Bretton Wood Twins

As both institutions are outcome of a conference – “United Nations Monetary and Financial Conference” at the Mount Washington Hotel in In Bretton Woods, New Hampshire in 1944. They are popularly referred as Brettonwood twins.

Purpose of Bretton wood institutions

The basic aim was to help rebuild the shattered post-war economy ( WW2 had just finished in 1945) and to promote international economic cooperation.

After the war, the major powers were determined not to repeat the mistakes of the Great Depression, some of which were ascribed to post–World War I policy errors.

Structurally, the victorious Allies established the United Nations and the Bretton Woods monetary system, international institutions designed to promote stability.

Marshal Plan, 1947

The Marshall Plan or European Recovery Program was the large-scale American program to aid Europe where the United States gave monetary support to help rebuild European economies after the end of World War II in order to combat the spread of Soviet communism.

The plan was in operation for four years beginning in April 1948. The first recipient of World Bank aid was France. Initially the lending of World Bank was low and it increased later on. The Marshall Plan of 1947 caused lending by the bank to change as many European countries received aid that competed with World Bank loans.

After that, the emphasis of World Bank was shifted to non-European countries and until 1968; loans were earmarked for projects that would enable a borrower country to repay loans (such projects as ports, highway systems, and power plants). From 1968 onwards, World Bank President Robert McNamara shifted bank policy toward measures such as building schools and hospitals, improving literacy and agricultural reform. This led to rise in the third world lending. This system was changed from 1980 by A.W. Clausen.

The Bretton Woods System

John Maynard Keynes in Britain and Harry Dexter White in the United States were the architects behind the attempt to design a new and liberal international economic order.

The results of their deliberations were formalised in The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference.

Established the International Bank for Reconstruction and Development (IBRD) and the International Monetary Fund (IMF). They were formally introduced in December 1945.

The World Bank Group, initially called the IBRD was established to provide assistance to countries that had been physically and financially devastated by World War II.

The main objective of the IMF was to seek stability in exchange rates. They developed a system of pegged but adjustable exchange rates according to what was called the par (equal) value system.

Another goal of the IMF was the reconciliation of country adjustments to payments imbalances with the national autonomy in macroeconomics policy, Countries experiencing balance of payments difficulties were expected to approach the fund.

If difficulties were deemed temporary, a loan would be provided to finance the payments imbalance until it reversed itself. Thus there would be no need for alteration of the deficit nation’s macro policies in the direction of sacrificing internal goals.

Further borrowing was subjected to increasingly stringent conditions which were designed to ensure that the borrowing country is taking action to reduce its balance of payments deficit.

IMF’s responsibilities

The IMF’s primary purpose is to ensure the stability of the international monetary system—the system of exchange rates and international payments that enables countries (and their citizens) to transact with each other. The Fund\’s mandate was updated in 2012 to include all macroeconomic and financial sector issues that bear on global stability.

Objectives:

- Promote international monetary cooperation;

- Facilitate the expansion and balanced growth of international trade;

- Promote exchange stability;

- Assist in the establishment of a multilateral system of payments; and

- Make resources available (with adequate safeguards) to members experiencing balance of payments difficulties.

What IMF does?

The IMF’s fundamental mission is to ensure the stability of the international monetary system. It does so in three ways:

Surveillance

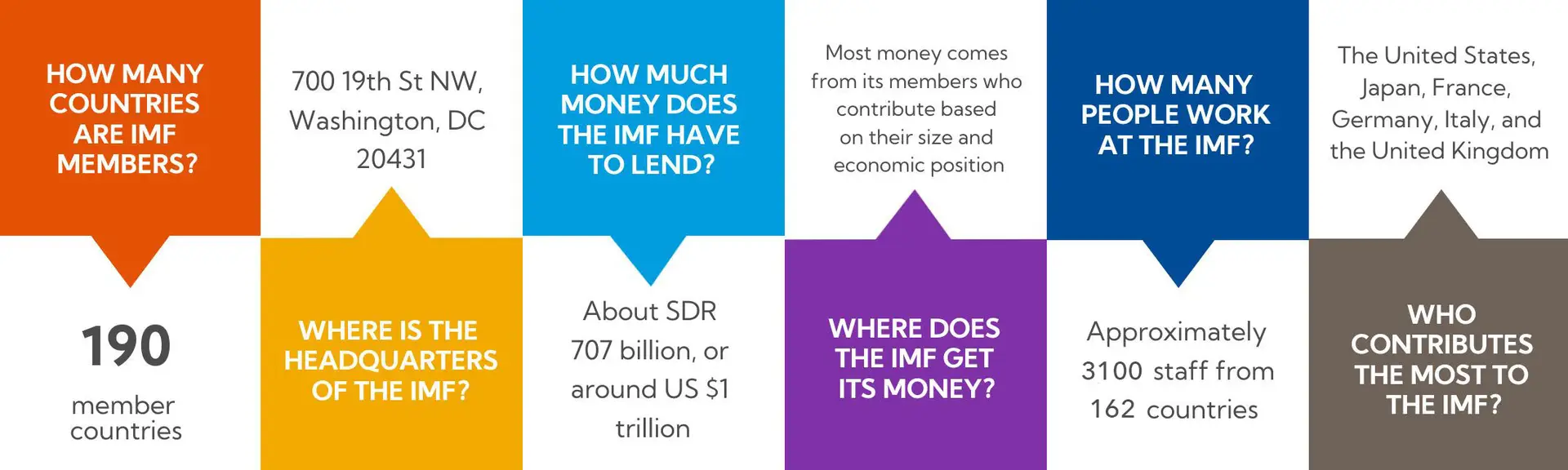

The IMF oversees the international monetary system and monitors the economic and financial policies of its 189 member countries. As part of this process, which takes place both at the global level and in individual countries, the IMF highlights possible risks to stability and advises on needed policy adjustments.

It also provides periodic assessments of global prospects in its “World Economic Outlook”, of financial markets in its “Global Financial Stability Report” , of public finance developments in its “Fiscal Monitor“ , and of external positions of the largest economies in its External Sector Report , in addition to a series of regional economic outlooks.

Capacity Development

IMF capacity development—technical assistance and training—helps member countries design and implement economic policies that foster stability and growth by strengthening their institutional capacity and skills.

The IMF seeks to build on synergies between technical assistance and training to maximize their effectiveness.

Lending

A core responsibility of the IMF is to provide loans to member countries experiencing actual or potential balance of payments problems.

This financial assistance enables countries to rebuild their international reserves, stabilize their currencies, continue paying for imports, and restore conditions for strong economic growth, while undertaking policies to correct underlying problems.

Unlike development banks, the IMF does not lend for specific projects.

IMF Quotas

When a country joins the IMF, it is assigned an initial quota in the same range as the quotas of existing members of broadly comparable economic size and characteristics. The IMF uses a quota formula to help assess a member’s relative position.

What is the current quota formula: The current quota formula is a weighted average of

- GDP (weight of 50 percent): For this purpose, GDP is measured through a blend of GDP—based on market exchange rates (weight of 60 percent) and on PPP exchange rates (40percent).

- Openness (30 percent),

- Economic variability (15 percent), and

- International reserves (5 percent).

Quotas play several key roles in the IMF: A member\’s quota determines that country’s financial and organizational relationship with the IMF, including:

- Subscriptions: A member\’s quota subscription determines the maximum amount of financial resources the member is obliged to provide to the IMF. A member must pay its subscription in full upon joining the IMF: up to 25 percent must be paid in SDRs or widely accepted currencies (such as the US dollar, the euro, the Japanese yen, or the British pound sterling), while the rest is paid in the member\’s own currency.

- Voting power: The quota largely determines a member\’s voting power in IMF decisions. Each IMF member’s votes are comprised of basic votes plus one additional vote for each SDR100,000 of quota. The 2008 reforms fixed the number of basic votes at 5.502 percent of total votes. The current share of basic votes in total votes represents close to a tripling of their share prior to the implementation of the 2008 reforms.

- Access to financing: The amount of financing a member can obtain from the IMF (its access limit) is based on its quota. For example, under Stand-By and Extended Arrangements, a member can borrow up to 145 percent of its quota annually and 435 percent cumulatively. However, access may be higher in exceptional circumstances.

How quota reviews work: There are two main issues addressed in a general quota review:

- First, a general quota review allows the IMF to assess the adequacy of quotas both in terms of members’ balance of payments financing needs and in terms of its own ability to help meet those needs.

- Second, a general review allows for increases in members’ quotas to reflect changes in their relative positions in the world economy.

Where the IMF gets its Money? Who Funds IMF?

IMF funds come from three sources: member quotas, multilateral and bilateral borrowing agreements.

Member quotas are the primary source of IMF funding. A member country’s quota reflects its size and position in the world economy.

New Arrangements to Borrow (NAB) between the IMF and a group of members and institutions are the main backstop for quotas. The size of the NAB was doubled in 2021. The NAB currently contributes SDR 364 billion, or $489 billion, to total IMF resources.

Member countries also have committed resources through bilateral borrowing agreements (BBAs). In 2020, the IMF Executive Board approved a new round of BBAs, which currently contribute SDR 141 billion, or $189 billion, to total IMF resources.

Loans Extended by IMF to its Member’s

IMF provides various types of Credit facilities to its member countries,

Unlike development banks, the IMF does not lend for specific projects. Instead, the IMF provides financial support to countries hit by crises to create breathing room as they implement policies that restore economic stability and growth. It also provides precautionary financing to help prevent crises. IMF lending is continuously refined to meet countries’ changing needs.

The causes of crises are varied and complex. They can be domestic, external, or both.

Domestic factors include inappropriate fiscal and monetary policies, which can lead to large current account and fiscal deficits and high public debt levels; an exchange rate fixed at an inappropriate level, which can erode competitiveness and result in the loss of official reserves, and a weak financial system, which can create economic booms and busts. Political instability and weak institutions also can trigger crises.

External factors include shocks ranging from natural disasters to large swings in commodity prices. Both are common causes of crises, especially for low-income countries. With globalization, sudden changes in market sentiment can result in capital flow volatility. Even countries with sound fundamentals can be severely affected by economic crises and policies elsewhere.

The COVID-19 pandemic was an example of external shock affecting countries across the globe. The IMF responded with unprecedented financial assistance to help countries protect the most vulnerable and set the stage for economic recovery.

The IMF has several lending instruments to meet the different needs and specific circumstances of its members.

IMF members have access to the General Resources Account on non-concessional terms (market-based interest rates), but the IMF also provides concessional financial support (currently at zero interest rates) through the Poverty Reduction and Growth Trust, which is better tailored to the diversity and needs of low-income countries. The recently established Resilience and Sustainability Trust offers longer-term financing to low-income and vulnerable middle-income countries seeking to build resilience to external shocks at affordable interest rates.

Some of IMF Lending instruments

Standby Arrangement(SBA), Extended Fund Facility(EFF), Rapid Financing Instrument(RFI), Flexible Credit Line(FCL), Short term Liquidity Line(SLL), Precautionary and Liquidity Line(PLL).

Standby Credit Facility(SCF), External Credit Facility(ECF), Rapid Credit Facility(RCF).

What is International Reserve

International reserves (or reserve assets in the balance of payments) are those external assets that are readily available to and controlled by a country’s monetary authorities. Reserve assets, as per the International Monetary Fund’s (IMF) balance of payments manual, must, at a minimum, comprise the following financial assets:

Gold

Foreign currencies: By far the most important official reserve. The currencies must be tradable (can buy/sell anywhere), such as the USD or euro (EUR).

Special drawing rights (SDRs): Represent rights to obtain foreign exchange or other reserve assets from other IMF members.

Reserve position with the IMF: Reserves that the country has given to the IMF that are readily available to the member country.

These reserves may be used for direct financing of international payments imbalances, or for indirect regulation of the magnitude of such imbalances via intervention in foreign exchange markets in order to affect the exchange rate of the country’s currency.

Special drawing rights(SDR)

SDR Introduced in response to concerns about the limitations of gold and dollars as the sole means of settling international accounts, SDRs augment international liquidity by supplementing the standard reserve currencies.

What is Special Drawing Rights (SDR): The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The value of the SDR is based on a basket of five major currencies—the US dollar, the euro, the Chinese renminbi (RMB), the Japanese yen, and the British pound sterling.

The SDR is neither a currency, nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. In addition to its role as a supplementary reserve asset, the SDR serves as the unit of account of the IMF and some other international organizations.

Reforms in IMF

On December 15, 2010, the Board of Governors, the IMF’s highest decision-making body, completed the 14th General Review of Quotas, which involved a package of far-reaching reforms of the IMF’s quotas and governance.

Building on the 2008 reforms, the 14th General Review of Quotas:

- Doubled quotas from approximately SDR238.5 billion to approximately SDR477 billion (about $653 billion at current exchange rates),

- Shifted more than 6 percent of quota shares from over-represented to under-represented member countries,

- Shifted more than 6 percent of quota shares to dynamic emerging market and developing countries (EMDCs),

- Significantly realigned quota shares. China became the third largest member country in the IMF, and there are now four EMDCs (Brazil, China, India, and Russia) among the 10 largest shareholders in the IMF, and

- Preserved the quota and voting share of the poorest member countries.

Governance

- Country Representation: Unlike the General Assembly of the United Nations, where each country has one vote, decision making at the IMF was designed to reflect the relative positions of its member countries in the global economy. The IMF continues to undertake reforms to ensure that its governance structure adequately reflects fundamental changes taking place in the world economy.

- Accountability: Created in 1945, the IMF is governed by and accountable to the 189 countries that make up its near-global membership.

- Corporate Responsibility: The Fund actively promotes good governance within its own organization.

Governance Reforms:

The International Monetary Fund’s (IMF) 14th General Quota Review delivers historic and far-reaching changes to the governance structure. The reforms represent a major step toward better reflecting in the institution’s governance structure the increasing role of dynamic emerging market and developing countries. The entry into force of these reforms will reinforce the credibility, effectiveness, and legitimacy of the IMF. Following are the reforms:

- For the first time four emerging market countries (Brazil, China, India, and Russia) will be among the 10 largest members of the IMF.

- For the first time, the IMF’s Board will consist entirely of elected Executive Directors, ending the category of appointed Executive Directors (currently the members with the five largest quotas appoint an Executive Director).

- Advanced European countries have committed to reduce their combined Board representation by two chairs.

- Following the effectiveness of the 14th General Review of Quotas, the focus will now turn to work on the 15th General Review of Quotas and securing the necessary broad consensus, including on a new quota formula.

Next Step: The 15th General Quota Review provides an opportunity to assess the appropriate size and composition of the IMF’s resources and to continue the process of governance reforms. On December 5, 2016, the Board of Governors adopted a Resolution calling on the Executive Board to work expeditiously on the 15th Review in line with existing Executive Board understandings and the guidance provided by the IMFC, and with the aim of completing the 15th Review by the 2019 Spring Meetings and no later than the 2019 Annual Meetings.

15th General Quota Review:

15th General Quota Review was disappointing for India as the quota not increased.

Why India need the quota to increase? India last borrowed money from the IMF in 1993 and it repaid all its outstanding by 2000 However, India doesn’t just represent itself — it also represents Bangladesh, Bhutan and Sri Lanka. An increase in quota therefore will not just benefit India but also the other three countries. We, however, consider this as a temporary setback. We hope that the discussions in the next [16th] Round of the GRQ would achieve success in terms of quota increase to take care of the Fund’s resource adequacy,

Other Outcomes:

- The deal is a compromise with the U.S., the Fund’s largest shareholder, which has resisted changes to the organisation’s voting structure as well as increases in its permanent resource base.

- It will allow an extension of non-permanent, supplementary sources of funds – such as the New Arrangement to Borrow (NAB), a renewable funding mechanism that has existed since 1998, and bilateral borrowings from countries – the IMF had entered into these after the 2008 financial crisis to increase its lending ability.

- The agreement extended the bilateral borrowing facility by a year – to the end of 2020 and a potential doubling of the NAB.

Need for reforms

- Some IMF members have become frustrated with the pace of governance reforms, as the balance of economic and geopolitical power has shifted, becoming more dispersed across the world, particularly with the emergence of China and India – among the world’s largest and fastest growing economies.

- India’s quota is 2.76% and China’s is 6.41%, while the U.S.’s quota is 17.46 % (translates to a vote share of 16.52%) giving it a unique veto power over crucial decisions at the IMF, many of which require a supermajority of 85%.

- The U.S. has resisted diluting its share, wary that it will benefit countries such as China

India and IMF

Balance of payment crisis

IMF and Structural adjustments

PYQ

Q. Regarding the International Monetary Fund, which one of the following statements is correct?(a) It can grant loans to any country

(b) It can grant loans to only developed countries

(c) It grants loans to only member countries

(d) It can grant loans to the central bank of a country

Correct Answer

Q. Regarding the International Monetary Fund, which one of the following statements is correct?(a) It can grant loans to any country

(b) It can grant loans to only developed countries

(c) It grants loans to only member countries

(d) It can grant loans to the central bank of a country.

Some of IMF Lending instruments

Standby Arrangement(SBA), Extended Fund Facility(EFF), Rapid Financing Instrument(RFI), Flexible Credit Line(FCL), Short term Liquidity Line(SLL), Precautionary and Liquidity Line(PLL).

Standby Credit Facility(SCF), External Credit Facility(ECF), Rapid Credit Facility(RCF).

What is International Reserve

International reserves (or reserve assets in the balance of payments) are those external assets that are readily available to and controlled by a country’s monetary authorities. Reserve assets, as per the International Monetary Fund\’s (IMF) balance of payments manual, must, at a minimum, comprise the following financial assets:

- Gold

- Foreign currencies: By far the most important official reserve. The currencies must be tradable (can buy/sell anywhere), such as the USD or euro (EUR).

- Special drawing rights (SDRs): Represent rights to obtain foreign exchange or other reserve assets from other IMF members.

- Reserve position with the IMF: Reserves that the country has given to the IMF that are readily available to the member country.

These reserves may be used for direct financing of international payments imbalances, or for indirect regulation of the magnitude of such imbalances via intervention in foreign exchange markets in order to affect the exchange rate of the country’s currency.

How SDR introduced

SDR Introduced in response to concerns about the limitations of gold and dollars as the sole means of settling international accounts, SDRs augment international liquidity by supplementing the standard reserve currencies.

What is Special Drawing Rights (SDR): The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The value of the SDR is based on a basket of five major currencies—the US dollar, the euro, the Chinese renminbi (RMB), the Japanese yen, and the British pound sterling.

The SDR is neither a currency, nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. In addition to its role as a supplementary reserve asset, the SDR serves as the unit of account of the IMF and some other international organizations.

PYQ

Q. Recently, which one of the following currencies has been proposed to be added to the basket of IMF’s SDR?

(a) Rouble

(b) Rand

(c) Indian Rupee

(d) Renminbi

Correct Answer

Q. Recently, which one of the following currencies has been proposed to be added to the basket of IMF’s SDR?

(a) Rouble

(b) Rand

(c) Indian Rupee

(d) Renminbi

Reforms in IMF

2010 Reforms: Doubling of quotas and major realignment of quota shares

On December 15, 2010, the Board of Governors, the IMF’s highest decision-making body, completed the 14th General Review of Quotas, which involved a package of far-reaching reforms of the IMF’s quotas and governance.

Building on the 2008 reforms, the 14th General Review of Quotas:

- Doubled quotas from approximately SDR238.5 billion to approximately SDR477 billion (about $653 billion at current exchange rates),

- Shifted more than 6 percent of quota shares from over-represented to under-represented member countries,

- Shifted more than 6 percent of quota shares to dynamic emerging market and developing countries (EMDCs),

- Significantly realigned quota shares. China became the third largest member country in the IMF, and there are now four EMDCs (Brazil, China, India, and Russia) among the 10 largest shareholders in the IMF, and

- Preserved the quota and voting share of the poorest member countries.

Governance

- Country Representation: Unlike the General Assembly of the United Nations, where each country has one vote, decision making at the IMF was designed to reflect the relative positions of its member countries in the global economy. The IMF continues to undertake reforms to ensure that its governance structure adequately reflects fundamental changes taking place in the world economy.

- Accountability: Created in 1945, the IMF is governed by and accountable to the 189 countries that make up its near-global membership.

- Corporate Responsibility: The Fund actively promotes good governance within its own organization.

Governance Reforms:

The International Monetary Fund’s (IMF) 14th General Quota Review delivers historic and far-reaching changes to the governance structure. The reforms represent a major step toward better reflecting in the institution’s governance structure the increasing role of dynamic emerging market and developing countries. The entry into force of these reforms will reinforce the credibility, effectiveness, and legitimacy of the IMF. Following are the reforms:

- For the first time four emerging market countries (Brazil, China, India, and Russia) will be among the 10 largest members of the IMF.

- For the first time, the IMF’s Board will consist entirely of elected Executive Directors, ending the category of appointed Executive Directors (currently the members with the five largest quotas appoint an Executive Director).

- Advanced European countries have committed to reduce their combined Board representation by two chairs.

- Following the effectiveness of the 14th General Review of Quotas, the focus will now turn to work on the 15th General Review of Quotas and securing the necessary broad consensus, including on a new quota formula.

Next Step: The 15th General Quota Review provides an opportunity to assess the appropriate size and composition of the IMF’s resources and to continue the process of governance reforms. On December 5, 2016, the Board of Governors adopted a Resolution calling on the Executive Board to work expeditiously on the 15th Review in line with existing Executive Board understandings and the guidance provided by the IMFC, and with the aim of completing the 15th Review by the 2019 Spring Meetings and no later than the 2019 Annual Meetings.

15th General Quota Review:

15th General Quota Review was disappointing for India as the quota not increased.

Why India need the quota to increase? India last borrowed money from the IMF in 1993 and it repaid all its outstanding by 2000 However, India doesn’t just represent itself — it also represents Bangladesh, Bhutan and Sri Lanka. An increase in quota therefore will not just benefit India but also the other three countries. We, however, consider this as a temporary setback. We hope that the discussions in the next [16th] Round of the GRQ would achieve success in terms of quota increase to take care of the Fund’s resource adequacy,

Other Outcomes:

- The deal is a compromise with the U.S., the Fund’s largest shareholder, which has resisted changes to the organisation’s voting structure as well as increases in its permanent resource base.

- It will allow an extension of non-permanent, supplementary sources of funds – such as the New Arrangement to Borrow (NAB), a renewable funding mechanism that has existed since 1998, and bilateral borrowings from countries – the IMF had entered into these after the 2008 financial crisis to increase its lending ability.

- The agreement extended the bilateral borrowing facility by a year – to the end of 2020 and a potential doubling of the NAB.

Need for reforms

- Some IMF members have become frustrated with the pace of governance reforms, as the balance of economic and geopolitical power has shifted, becoming more dispersed across the world, particularly with the emergence of China and India – among the world’s largest and fastest growing economies.

- India’s quota is 2.76% and China’s is 6.41%, while the U.S.’s quota is 17.46 % (translates to a vote share of 16.52%) giving it a unique veto power over crucial decisions at the IMF, many of which require a supermajority of 85%.

- The U.S. has resisted diluting its share, wary that it will benefit countries such as China

India and IMF

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

BoP Crisis

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

IMF and Structural Adjustments

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

World Bank

World Bank is a vital source of financial and technical assistance to developing countries around the world. This is not only a bank in the ordinary sense but a unique partnership to reduce poverty and support development.

Publications– Global economic prospects, Ease of doing business index.

Pre-Condition – A country has to first join IMF before it can join World Bank.

WB as an Organization: The World Bank is like a cooperative, made up of 189 member countries. These member countries, or shareholders, are represented by a Board of Governors, who are the ultimate policymakers at the World Bank. Generally, the governors are member countries\’ ministers of finance or ministers of development. They meet once a year at the Annual Meetings of the Boards of Governors of the World Bank Group and the International Monetary Fund.

PYQ

Q. Which one of the following issues the ‘Global Economic Prospects’ report periodically?

(a) The Asian Development Bank

(b) The European Bank for Reconstruction and Development

(c) The US Federal Reserve Bank

(d) The World Bank

Correct Answer

Q. Which one of the following issues the ‘Global Economic Prospects’ report periodically?

(a) The Asian Development Bank

(b) The European Bank for Reconstruction and Development

(c) The US Federal Reserve Bank

(d) The World Bank

PYQ

Q. Which one of the following is not a sub-index of the World Bank’s ‘Ease of Doing Business Index’?

(a) Maintenance of law and order

(b) Paying taxes

(c) Registering property

(d) Dealing with construction permits

Correct Answer

Q. Which one of the following is not a sub-index of the World Bank’s ‘Ease of Doing Business Index’?

(a) Maintenance of law and order

(b) Paying taxes

(c) Registering property

(d) Dealing with construction permits

PYQ

Q. India’s ranking in the ‘Ease of Doing Business Index’ is sometimes seen in the news. Which of the following has declared that ranking?

(a) Organization for Economic Cooperation and Development (OECD)

(b) World Economic Forum

(c) World Bank

(d) World Trade Organization (WTO)

Correct Answer

Q. India’s ranking in the ‘Ease of Doing Business Index’ is sometimes seen in the news. Which of the following has declared that ranking?

(a) Organization for Economic Cooperation and Development (OECD)

(b) World Economic Forum

(c) World Bank

(d) World Trade Organization (WTO)

Q. With reference to `IFC Masala Bonds’, sometimes seen in the news, which of the statements given below is/are correct?

1. The International Finance Corporation, which offers these bonds, is an arm of the World Bank.

2. They are the rupee-denominated bonds and are a source of debt financing for the public and private sector.

Select the correct answer using the code given below

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither1 nor 2

Correct Answer

Q. With reference to `IFC Masala Bonds’, sometimes seen in the news, which of the statements given below is/are correct?

1. The International Finance Corporation, which offers these bonds, is an arm of the World Bank.

2. They are the rupee-denominated bonds and are a source of debt financing for the public and private sector.

Select the correct answer using the code given below

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither1 nor 2

PYQ

Q. Consider the following statements:

1. New Development Bank has been set up by APEC.

2. The headquarters of New Development Bank is in Shanghai.

Which of the statements given above is/ are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Correct Answer

Q. Consider the following statements:

1. New Development Bank has been set up by APEC.

2. The headquarters of New Development Bank is in Shanghai.

Which of the statements given above is/ are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Asian Development Bank

When? 1966

Members: 67 members – 48 from the region including India

HQ: Manila, Philippines

Aim: To accelerate economic and social development in Asia and pacific region

Functions of Asian Development Bank (ADB)

- To make loans and equity investments for economic and social development of its developing members countries.

- To provide for technical assistance for the preparation and implementation of development projects and advisory services.

- To respond to the request for assistance in coordinating developmental policies and plans in developing member countries.

- This bank constituted Asian Development Fund in 1974, which provides loans to Asian countries on concessional interest rates.

Areas of Focus and Results

ADB operations are designed to support the three complementary agendas of inclusive economic growth, environmentally sustainable growth, and regional integration. ADB uses its scarce resources in the areas of comparative strength.

Its key areas are as follows:

- Infrastructure (water, energy, transport, urban development, information and communications technology)

- Environment

- Regional cooperation and integration

- Finance sector development

- Education

- Health

- Agriculture and natural resources

- Public sector management

India and the ADB

The ADB has played a key role in India’s developmental story. ADB has a robust Country Partnership Strategy. The Country Partnership Strategy (CPS), 2018–2022 for India has the goal of supporting the government’s aim of “faster, inclusive, and sustainable growth accompanied by rapid economic transformation and job creation”.

The CPS is focussed on three strategic pillars:

- Boosting economic competitiveness to create more and better jobs;

- Providing inclusive access to infrastructure networks and services; and

- Addressing climate change and increasing climate resilience.

ADB’s annual lending to India is proposed to be raised to a maximum of $4 billion to support the country’s transformation toward upper middle-income status. Recently in October 2018 the Government of India and the Asian Developmental Bank (ADB) signed a $150 million agreement. It is meant to make improvements to road connectivity and efficiency of the international trade corridor in northern part of West Bengal and north-eastern region of India.

PYQ

Q. Consider the following statements:

1. India is a member of the International Grains Council.

2. A country needs to be a member of the International Grains Council for exporting or importing rice and wheat.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Correct Answer

Q. Consider the following statements:

1. India is a member of the International Grains Council.

2. A country needs to be a member of the International Grains Council for exporting or importing rice and wheat.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

PYQ

Q. The term ‘Digital Single Market Strategy’ seen in the news refers to

(a) ASEAN

(b) BRICS

(c) EU

(d) G20

Correct Answer

Q. The term ‘Digital Single Market Strategy’ seen in the news refers to

(a) ASEAN

(b) BRICS

(c) EU

(d) G20

PYQ

Q. With reference to the International Monetary and Financial Committee (IMFC), consider the following statements:

1. IMFC discusses matters of concern affecting the global economy, and advises the International Monetary Fund (IMF) on the direction of its work.

2. The World Bank participates as observer in MFC’s meetings,

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither I nor 2

Correct Answer

Q. With reference to the International Monetary and Financial Committee (IMFC), consider the following statements:

1. IMFC discusses matters of concern affecting the global economy, and advises the International Monetary Fund (IMF) on the direction of its work.

2. The World Bank participates as observer in MFC’s meetings,

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither I nor 2