Note: Basics of Economics, covers concepts that are required for further understanding of the other economics topics, if you have already read NCERT’s or a student with economics background, you can skip the topic “Basics of Economics”.

What is Economics?

“I want to become an IAS officer”, “I need to become an IAS officer”

Is there a difference between the above two statements?

Let’s try to start our journey of economics with these two statements,

Need, Want and Greed?

A Need is something that a person must have in order to thrive(Necessity), a decent source of income(a job).

A Want is a choice(desire to become an IAS officer). A desire, which a person may or may not be able to get. Life goes on if a person doesn’t get what they want.

Example: We need to eat in order to live. But the choice of what to eat leans toward want.

Each person has his or her own list of wants, each with a varying level of importance. Furthermore, wants can change over a period of time. This is in contrast to needs, which remain constant throughout the lifetime of the person.

Greed is a desire to have more of something than you need. Greed is not having enough to meet mental and emotional requirements. In simple, greed is a selfish want for something beyond one’s need.

Typically, greed is associated with wealth or power. Greed describes a desire to have or acquire something that is not necessary for their own survival but also to the detriment of another.

Example: A person who refuses to pay his income taxes that he is required by law to pay because he wants to keep more of the money he earned for himself, despite the cost to society as a whole.

“Our wants are unlimited but the resources are scarce.”

“The first lesson of economics is scarcity: there is never enough of anything to fully satisfy all those who want it”.

Fundamentally, without scarcity, there would be no need for economics because we would have an infinite supply of anything we could imagine available immediately for no cost or trade off.

Trade off

To get one thing, we usually have to give up something else. Making decisions requires trading one goal for another(pursuing the dream of becoming an IAS officer or a film actor).

Example: Allocating Resources to produce Guns or Grains, Equality Vs Efficiency, Environment Vs Faster Growth, IAS Officer or Film Actor.

Opportunity Cost – The cost of next best alternative

“The Cost of Something is What You Give Up to Get It”.

Because people face trade off, making decisions requires comparing the costs and benefits of alternative courses of action.

Opportunity cost is whatever must be given up in order to obtain some item or next best alternative forgone.

Example: The opportunity cost of preparing civil services is the money you could have earned if you used that time to work.

“Similarly the money the government spends(taxpayers money) on freebies is the money it can’t afford to spend on infrastructure”.

Many people hear the word economics and think it is all about money, economics is not just about money. It is about weighing different choices or alternatives. Some of those important choices involve money, but most do not. Most of your daily, monthly, or life choices have nothing to do with money, yet they are still the subject of economics.

“ Studying economics might not make you rich, but it definitely helps you understand why you are poor ”.

It is that discipline of study which is concerned with the production, consumption, and transfer of wealth.

Economics, at its core, is the study of how best to use those limited resources. In basic terms, economics is an academic attempt to put the world’s limited resources to their best use.

Difference between Economics and Economy

The relation between economics and the economy, is that of theory and practice. While the former is a discipline studying economic behaviour of human beings, the latter is a still frame picture of it.

Economy is economics at play in a certain region. This region is best defined today as a country, a nation – the French Economy, the Russian Economy, etc. economy as such means nothing. It gets meaning once it is preceded by the name of a country, a region, block, etc.

Economic Activity and Non-Economic Activity

Economic Activity: An economic activity is an activity of providing, making, buying, or selling of commodities or services by people to satisfy their day-to-day needs of life. Economic activities include any activity that deals with the manufacturing, distributing, or utilising of products or services.

“Any activity that has a value and price attached”

Example: Business, Job

Non-Economic Activity: A non-economic activity is an activity performed with the purpose of rendering services to others without any considerations of financial gains. Activities that are initiated for personal content or for meeting human sentiments are non-economic activities.

“Any activity that has a value and no price attached”

Example: Free time activities, Social welfare activities

The two main branches of Economics

- Micro Economics

- Macro Economics

Microeconomics

Study of economics at an individual, group or company level, it explores issues such as how families reach decisions about what to buy and how much to save.

- Microeconomics explains the inter –relationships between economic units like consumers, commodities, firms, industries, markets, etc.

- Microeconomic theory describes product pricing which explains the theories of demand, production, and factor pricing which explains concepts of wages, rent, interest, and profit.

- Understanding microeconomics helps a great deal on individual decision making i.e., managerial decision making.

Macroeconomics

Study of a national economy as a whole. Macroeconomists study aggregated indicators such as GDP, unemployment rates, national income, price indices, and the interrelations among the different sectors of the economy to better understand how the whole economic functions..

- Macroeconomics analyses the fluctuations and trends in the overall economic activity in a country and/or between various countries in the world.

- Macroeconomic theory describes the theory of income and employment to explain economy – wide consumption and investment, the theory of economic growth, and the macro theory of distribution.

- Macroeconomic study is vital in the formulation and execution of economic policies by government.

- Macroeconomic analysis includes study of national aggregates of output, income, expenditure, savings and investment.

Welfare Economics

Welfare economics focuses on the optimal allocation of resources and goods and how the allocation of these resources affects social welfare. This relates directly to the study of income distribution and how it affects the common good.

Behavioural Economics

The study of psychology as it relates to the economic decision making processes of individuals and institutions.

The two most important questions in this field are:

Are economists’ assumptions of profit maximization, good approximations of real people’s behaviour?

Do individuals take decisions in such a fashion that their profitability maximises?

Behavioural economics explores why people sometimes make irrational decisions, and why and how their behaviour does not follow the predictions (forecast/expectations ) of economic models.

Factors of production

Land

By land in economics we mean all that is given to us free by nature, on or below or above the surface of the earth. On the surface it includes, the soil, water, forests etc. below the surface it includes mineral deposits, water streams, petroleum etc., and above the surface it includes the sun, light, wind etc.

As the land(natural resource) became scarce, sale and purchase of land started. Those who owned land started charging price for the use of land. Such a payment to the land owner/landlord is termed as rent.

Labour

Labour includes all physical and mental efforts of human beings used for production of goods and services. These physical and mental efforts are inseparable. A worker requires both. Some of the jobs requires more of physical labour than mental labour and some jobs require more mental labour than physical labour.

The remuneration paid to the workers is popularly termed as wages and salaries. In national income accounting, it is termed as compensation of employees(wage).

Capital

Capital includes all the man made resources used for producing goods and services like structures on land(buildings), machines, equipment’s, vehicles, stock of materials etc.

The payment made to the owner of capital for the use of capital is termed as interest.

Fixed Capital Vs Working Capital

Fixed capital refers to any kind of physical assets like buildings, machinery it stays in business for a long time ans experience depreciation over the period of its usage.

Working capital refers to investments made on raw materials, inventory etc,. normally they are meant to be consumed in a year or in single product cycle.

Human Capital

The term human capital refers to the economicvalue of a worker’s experience and skills. Human capital includes assets like education, training, intelligence, skills, health, and other things employers value.

Physical Capital

Physical capital is the physical property or tangible assets that the company owns. This would include the buildings or other real estate the company owns, machinery, tools, and equipment. These items can be sold directly, often depreciate over time or with use, and will be listed in financial statements as assets.

Intellectual Capital

For most companies, intellectual capital comprises the larger share of value – perhaps up to 80% of valuation is dependent on things that cannot be held or sold directly. Intellectual capital is comprised of things the company’s management or employees contribute to its overall profitability like:

- Knowledge

- Talent

- Skills

- Abilities

Capital Output Ratio

- Capital Output Ratio (COR) is the amount of capital required to produce one unit of output.

- It is the relationship between the level of investment made in the economy and the consequent increase in Gross Domestic Product (GDP).

- It also expresses the relationship between the value of capital invested and the value of output.

- Higher capital output ration indicates, one is using more capital to produce a given output, higher is the COR, lower is the efficiency of capital.

- Economies with higher COR tend to report low growth due to inefficient utilization of the scarce capital.

Example of COR:

- For example, investment in an economy is 32% of GDP, and the economic growth corresponding to this level of investment is 8%. Here, it means that an investment of Rs. 32 produces an output of Rs. 8. Therefore, the COR is 32/8 i.e., 4.

- In other words, to produce one unit of output, 4 units of capital are needed.

Incremental Capital Output Ratio(ICOR)

Is a metric that assesses the marginal(additional) amount of investment capital necessary for a country or other entity to generate the next unit of production.

It’s the additional units of capital investment needed to produce an additional unit of output.

Higher the ICOR, lesser is the efficiency of capital.

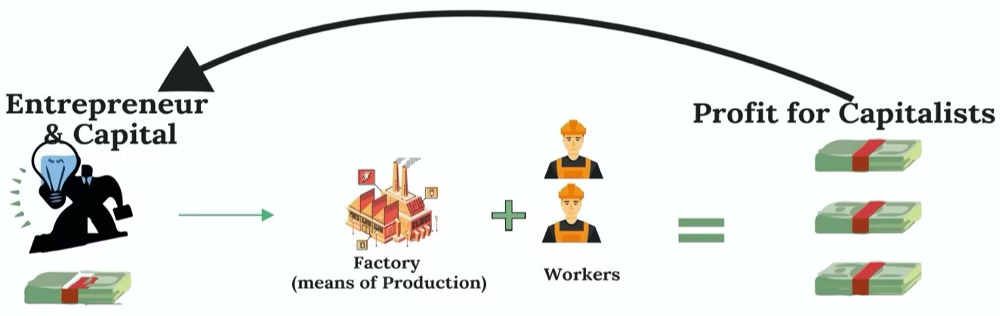

Entrepreneurship

It refers to the initiative taken by a person or a group of persons in starting and organising a business. Unless somebody takes this initiative, no business can be started. The one who takes this initiative is termed as entrepreneur.

The income accruing to the entrepreneur is termed as profit.

Thus compensation of employees(wages), rent, interest and profit are factor incomes of the factor owners.

Types of Goods

Finished goods

These are goods or products that do not require any further processing and are ready to be sold. But, it hasn’t been sold yet. After a product has been sold, it’s considered as merchandise.

By differentiating between finished goods that haven’t sold and between merchandise, businesses can determine how much inventory they have remaining versus how much profit they’ve made from selling the product.

Final Goods

Final goods refer to those goods which are used either for consumption or for investment.

Final Goods include:

- Goods purchased by consumer households as they are meant for final consumption (like milk purchased by households).

- Goods purchased by firms for capital formation or investment (like machinery purchased by a firm).

It must be noted that final goods are neither resold nor used for any further transformation in the process of production.

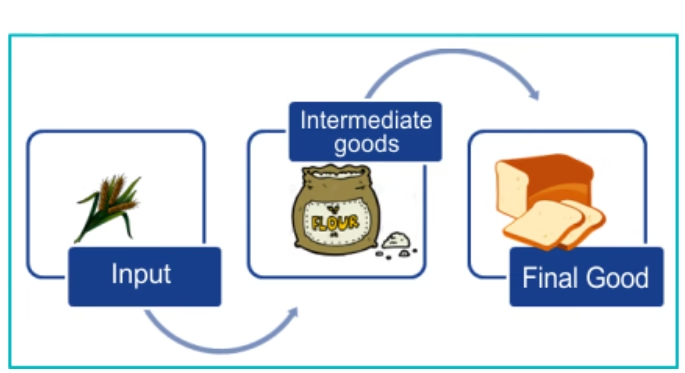

Intermediate goods

Raw materials, power, fuels etc. used by the producers for further production of final goods and services are called intermediate goods.

Example: Wheat flour is an intermediate good in the production of bread in the bakery.

Intermediate Goods include:

- Goods purchased for resale (like milk purchased by a Dairy Shop).

- Goods used for further production (like milk used for making sweets).

How to Classify Goods as: Intermediate Goods and Final Goods:

The distinction between intermediate goods and final goods is made on the basis of the use of product and not on the basis of product itself. A commodity can be an intermediate good as well as a final good, depending upon its nature of use.

For Example:

- Sugar is an intermediate good when it is used for making sweets by a sweet shop owner who sells sweets. However, if it is used by the consumers, then it becomes a final good.

- Similarly, milk is an intermediate good when it used in dairy shops for resale. However, it becomes a final good when it is used by the households.

Consumption goods

Goods which are consumed by the ultimate consumers or meet the immediate need of the consumer are called consumption goods. It may include services as well.

Expenditure made on consumption goods is called consumption expenditure, households and private firms consumption expenditure is referred as private final consumption expenditure(PFCE) and Govt’s expenditure on consumer goods is called as Government final consumption expenditure(GFCE).

Capital goods

Goods which are bought not for meeting immediate need of the consumer but for producing other goods.

Expenditure made on capital goods is referred as capital expenditure(CAPEX) or Gross fixed capital formation(GFCF).

Note: The difference between intermediate good and capital good is intermediate goods are exhausted in the process of production of other goods unlike capital goods.

Example: If you have a visited any coffee house, you might have noticed the coffee machine(capital good) is used to make many coffees whereas the coffee powder used to make a coffee cannot be reused(intermediate good).

Consumer durables Consumption goods which do not get exhausted immediately but last over a period of time are consumer durables.

Public good Goods or services that are collectively consumed; it is not possible to exclude anyone from enjoying their benefits and one person’s consumption does not reduce that available to others.

Free goods and economic goods: Free goods are free gifts of nature. They are available in abundance i.e. in unlimited quantity and the supply is much more than the demand.

Economic goods are those goods (manmade) whose demand is more than supply. They command a price and they can be bought in the market.

Consumer goods and Producer goods: This classification is based on the purpose for which a particular good is used. Consumer goods are those goods, which satisfy the want of consumer directly. For example bread, fruits, milk, clothes etc.

Producer goods are those goods, which satisfy the want of consumers indirectly. As they help in producing other goods, they are known as producer goods. For example machinery, tools, raw materials, seeds.

Sin Goods (Demerit Goods)

Sin goods are goods which consider harmful to society.

Example of sin goods: Alcohol and Tobacco, Candies, Drugs, Soft drinks, Fast foods, Coffee, Sugar, Gambling and Pornography.

What is sin tax?

It is placed on goods that adversely affect health, most notably tobacco and alcohol.

Three principal arguments are used to justify this type of taxation:

It can reduce consumption through increased prices.

Compensate society for things like increased health system costs.

Increase resources for the health sector.

White Goods

White goods are large home appliances such as stoves, refrigerators, freezers, washing machines, and air conditioners. They are large electrical goods for the house which were traditionally available only in white.

Even though you can purchase them today in a wide range of different colours, they continue being called white goods.

Free services and economic services: In case of services too, there are free services and economic services. Free services are those, which cannot be bought in the market and which are rendered due to love, affection etc.

All those services, which can be bought in the market, are economic services such as services of doctors, engineers etc.

Consumer’s services and Producer’s services

Here too the basis of classification is the same as that of goods. When the consumers or the households directly use services, they are known as consumer services. For example services of a tailor stitching your shirt or services of a doctor giving you the treatment or services of a plumber repairing your leaking tap, etc.

Producer services on the other hand are used to produce other goods and services, which are in turn demanded by the consumers. In other words producer services satisfy the human wants indirectly. For example a tailor stitches a shirt for a readymade garment shop, an electrician repairs fault in the electric supply in a production unit or even a truck transporting raw material to a factory.

Real sector in the economy

The real sector of an economy is the part that produces goods and services. Industries, Agriculture, manufacturing, construction, and mining.

Services: Healthcare, education, and transportation.

Black market

It deals with the trade of stolen items, lawfully banned or counterfeit items. Therefore, these goods or services are also traded in an illegal manner. For example, weapons and drugs are two most commonly traded black market items. Black market is closely related to brand abuse.

Grey market

usually deals with the genuine goods that are sold and bought through the unauthorized channel of distribution.

Grey market lies somewhere between the black and white markets. It generally deals with the genuine commodities. However, they lack the proper authorization or controlling factors.

A simple example of a grey market is the one which is developed by people who trade in goods at lower rates than the official rates. The goods of grey market are not like counterfeit goods of black market. It typically involves those services which are not registered legally in order to save taxes from the government. Thus, most often the distribution channel used is unauthorized or unofficial in the grey market.

The white market is the legal, official, authorized, or intended market for goods and services.

Demand and Supply Curves

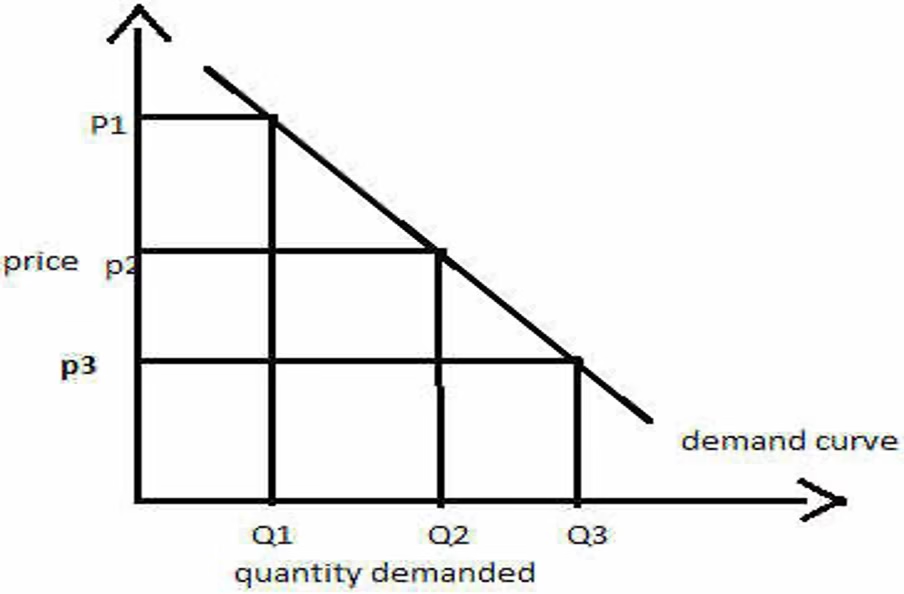

Law of Demand

Definition: The law of demand states that other factors(Income of the Consumer, Price of the Substitutes, Price of the Complementary, Tastes or Preferences) being constant (ceteris paribus), price and quantity demand of any good and service are inversely related to each other. When the price of a product increases, the demand for the same product will fall.

Description: Law of demand explains consumer choice/behaviour when the price changes. In the market, assuming other factors affecting demand being constant, when the price of a good rises, it leads to a fall in the demand of that good. This is the natural consumer choice behaviour. This happens because a consumer hesitates to spend more for the good with the fear of going out of cash.

The above diagram shows the demand curve which is downward sloping. Clearly when the price of the commodity increases from price p3 to p2, then its quantity demand comes down from Q3 to Q2 and then to Q3 and vice versa.

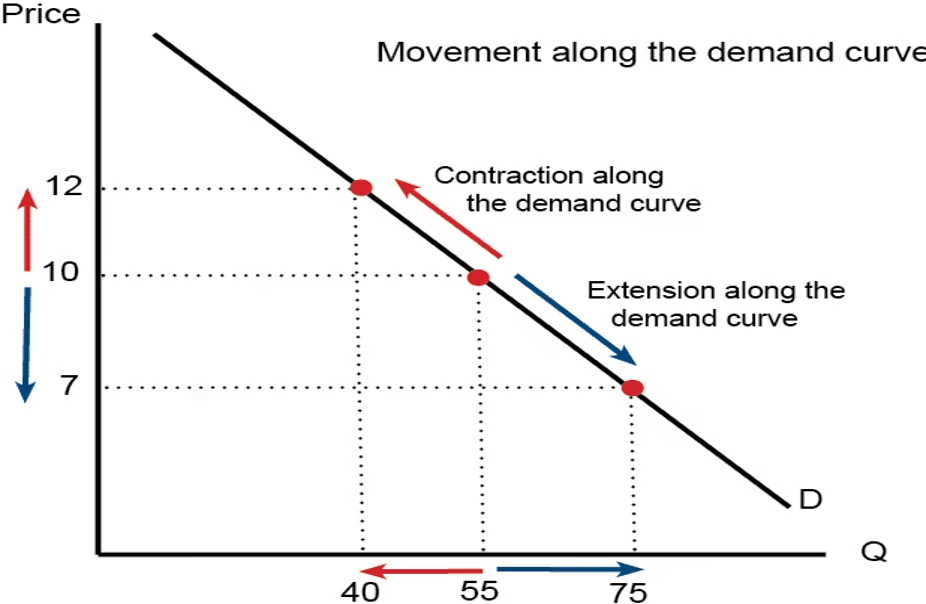

Movement along the Demand Curve:

A movement along the demand curve occurs following a change in price. A change in price causes a movement along the demand curve. It can either be contraction (less demand) or expansion (more demand).

Contraction in demand. An increase in price from $10 to $12 causes a movement along the demand curve, and quantity demand falls from 55 to 40. We say this is a contraction in demand.

Expansion in demand. A fall in price from $10 to $7 leads to an expansion (increase) in demand. and quantity demand rises from 55 to 75. As price falls, there is a movement along the demand curve and more is bought.

A change in price doesn’t shift the demand curve – we merely move from one point of the demand curve to another.

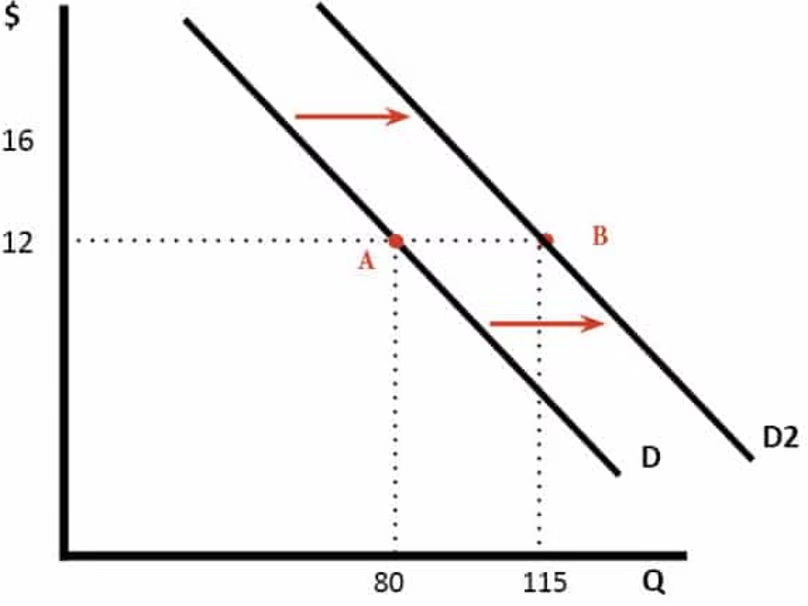

Shift of Demand Curve:

A shift in the demand curve occurs when the whole demand curve moves to the right or left. For example, an increase in income would mean people can afford to buy more widgets even at the same price.

The demand curve could shift to the right for the following reasons:

- The good became more popular (e.g. fashion changes)

- The price of a substitute good increased.

- The price of a complement good decreased.

A rise in incomes (assuming the good is a normal good, with positive YED).

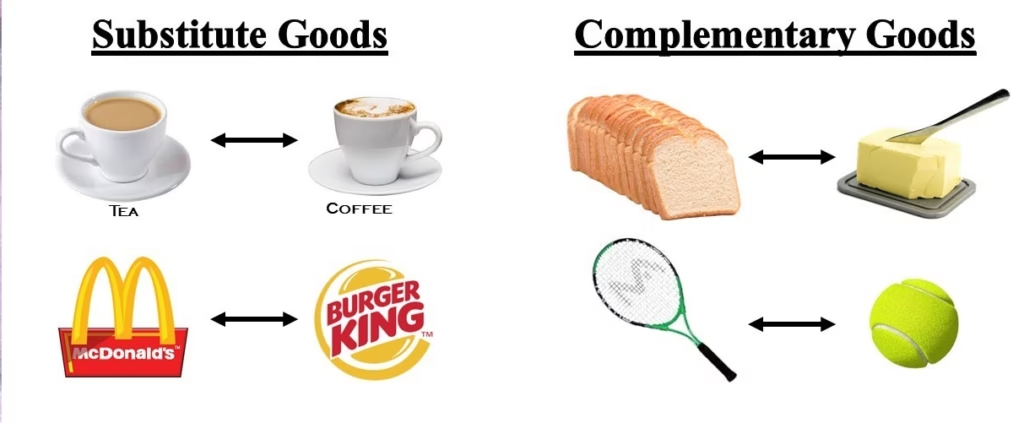

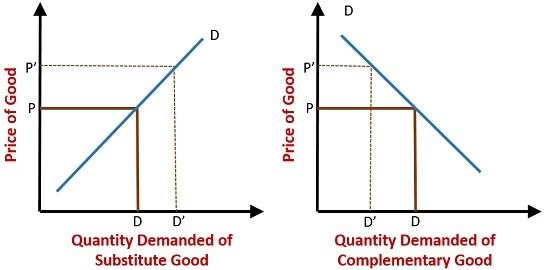

Substitute Goods

The demand for one good increases when the price for the substitute good increases. For example, if the price of coffee increases, the quantity demanded for tea (a substitute beverage) increases as consumers switch to a less expensive yet substitutable alternative.

Complementary Goods

Alternatively, the cross elasticity of demand for complementary goods is negative. As the price for one item increases, an item closely associated with that item and necessary for its consumption decreases because the demand for the main good has also dropped.

For example, if the price of coffee increases, the quantity demanded for coffee stir sticks drops as consumers are drinking less coffee and need to purchase fewer sticks.

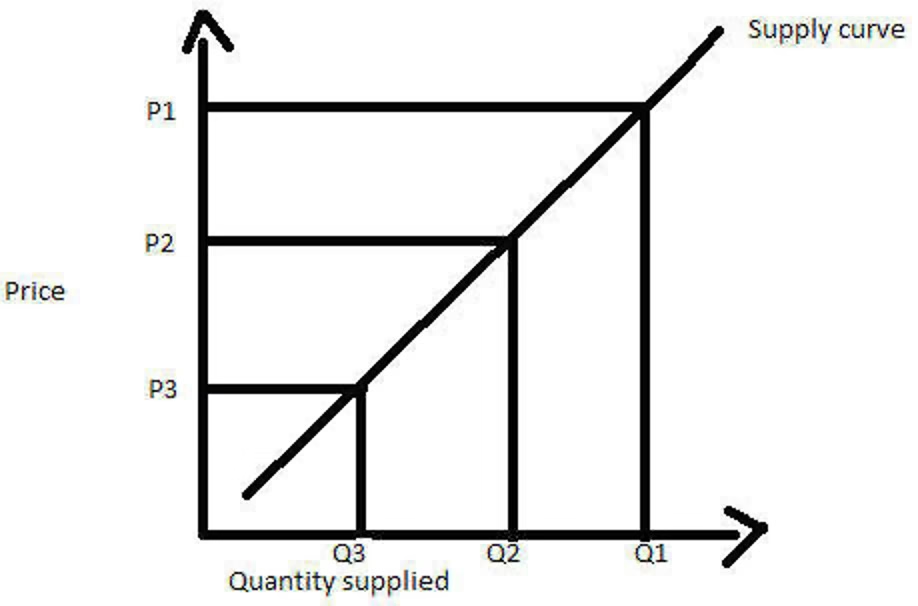

Law of Supply

Definition: Law of supply states that other factors remaining constant, price and quantity supplied of a good are directly related to each other. In other words, when the price paid by buyers for a good rises, then suppliers increase the supply of that good in the market.

Description: Law of supply depicts the producer behaviour at the time of changes in the prices of goods and services. When the price of a good rises, the supplier increases the supply in order to earn a profit because of higher prices.

The above diagram shows the supply curve that is upward sloping (positive relation between the price and the quantity supplied). When the price of the good was at P3, suppliers were supplying Q3 quantity. As the price starts rising, the quantity supplied also starts rising.

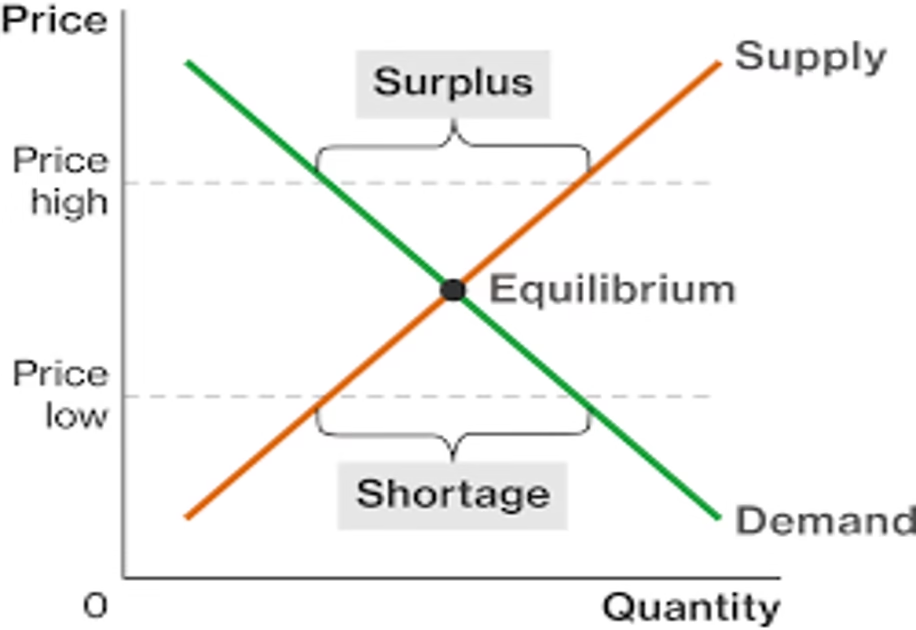

Equilibrium

Economic equilibrium is the combination of economic variables (usually price and quantity) toward which normal economic processes, such as supply and demand, drive the economy.

Equilibrium is a concept borrowed from the physical sciences, by economists who conceive of economic processes as analogous to physical phenomena such as velocity, friction, heat, or fluid pressure. When physical forces are balanced in a system, no further change occurs.

For example, consider a balloon. To inflate a balloon, you blow air into it, increasing the air pressure in the balloon by forcing air in. The air pressure in the balloon rises above the air pressure outside the balloon; the pressures are not balanced. As a result the balloon expands, lowering the internal pressure until it equals the air pressure outside. Once the balloon expands enough so that the air pressure inside and out are in balance, it stops expanding; it has reached equilibrium.

In economics we can think about something similar with regard to market prices, supply, and demand. If the price in a given market is too low, then the quantity that buyers demand will be more than the quantity that sellers are willing to offer. Like the air pressures in and around the balloon, supply and demand will not be in balance. consequently a condition of oversupply in the market, a state of market disequilibrium.

So something has to give; buyers will have to offer higher prices to induce sellers to part with their goods. As they do, the market price will rise toward the level where the quantity demanded equals the quantity supplied, just as a balloon will expand until the pressures equalize. Eventually it may reach a balance where quantity demanded just equals quantity supplied, and we can call this the market equilibrium.

Price Elasticity of Demand/Supply

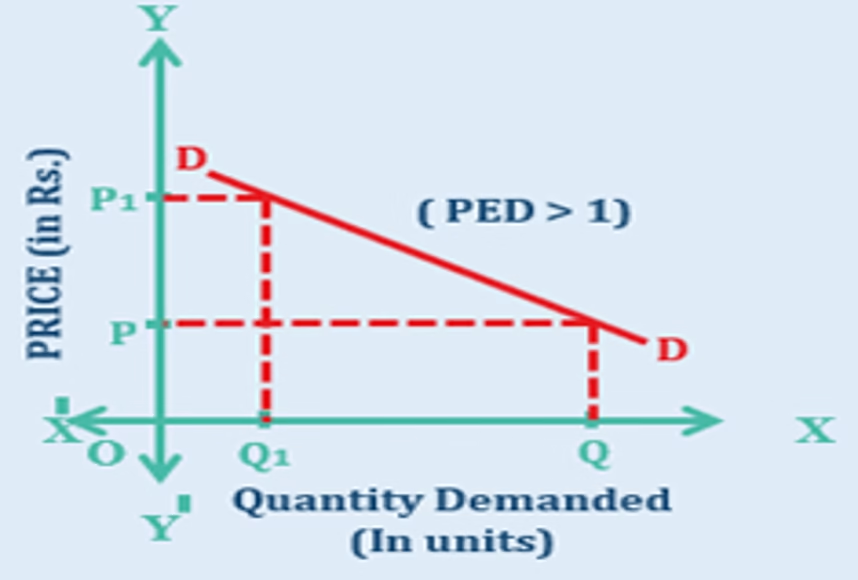

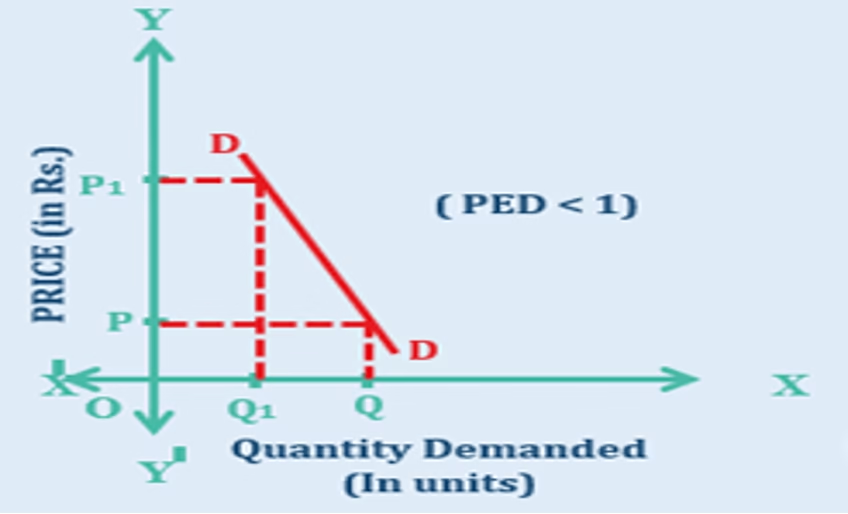

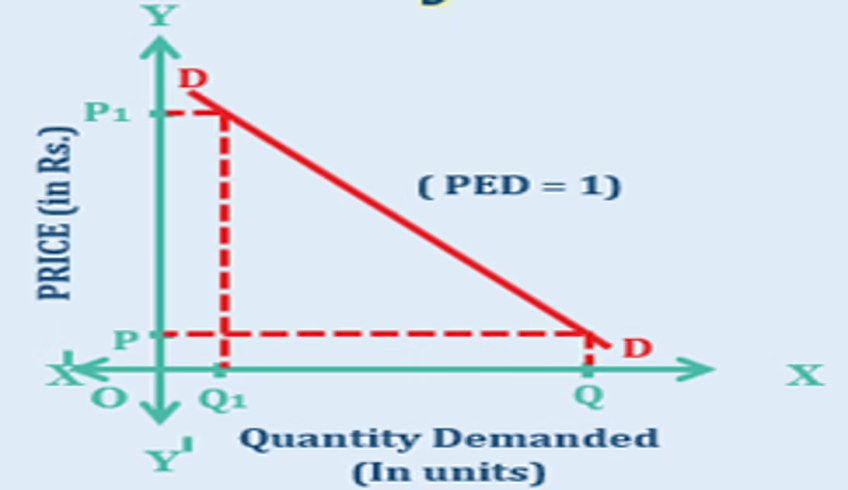

- Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It is computed as the percentage change in quantity demanded—or supplied—divided by the percentage change in price.

- Elasticity can be described as elastic—or very responsive—unit elastic, or inelastic—not very responsive.

- Elastic demand or supply curves indicate that the quantity demanded or supplied responds to price changes in a greater than proportional manner.

An inelastic demand or supply curve is one where a given percentage change in price will cause a smaller percentage change in quantity demanded or supplied.

Unitary elasticity means that a given percentage change in price leads to an equal percentage change in quantity demanded or supplied.

Income Elasticity of Demand

- Income elasticity of demand or YED is referred to as the corresponding change in the demand of a product in response to the change in a consumer’s income.

- A higher YED indicates that when the consumer’s income rises, there is a tendency to purchase more goods and services.

- Similarly, when there is a drop in income, the consumer shows a tendency towards frugal purchasing, which involves cutting down on buying more quantity of goods and services.

- When the YED is low, the change in consumer income has little effect on the demand for the product.

- Income elasticity of demand (YED) = Percentage change in the quantity demanded/Percentage change in income

Cross Price Elasticity

The cross price elasticity of demand is an economic concept that measures the responsiveness in the quantity demanded of one good when the price for another good changes. This measurement is calculated by taking the percentage change in the quantity demanded of one good and dividing it by the percentage change in the price of the other good.

- The cross elasticity of demand for substitute goods is always positive because the demand for one good increases when the price for the substitute good increases.

- Alternatively, the cross elasticity of demand for complementary goods is negative.

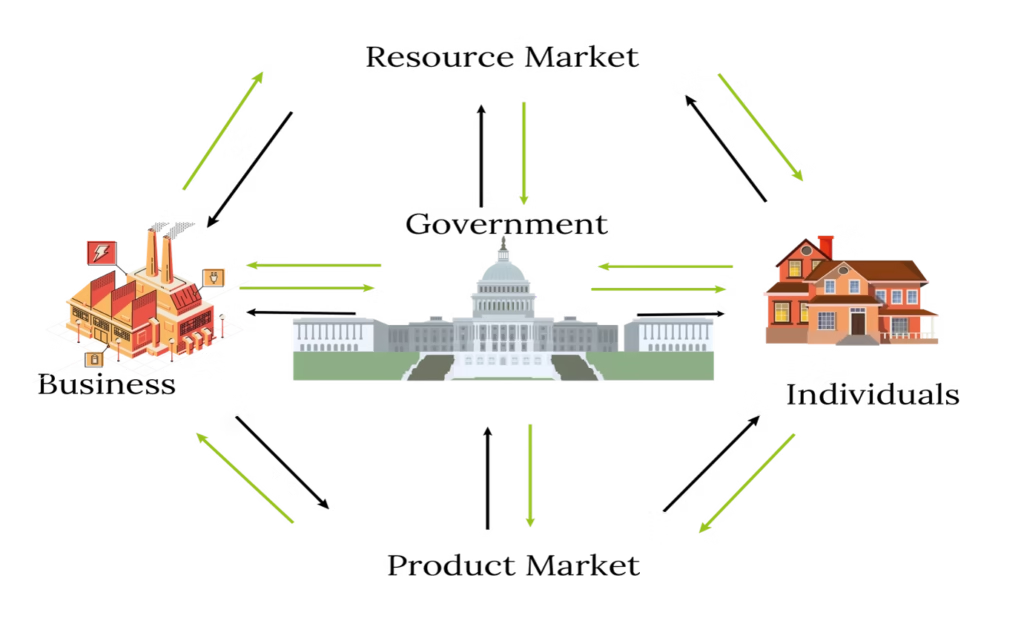

Role of State in an economy

In the narrowest sense, the government’s role in the economy is to help correct market failures, or situations where private markets cannot maximize the value that they could create for society.

This includes providing public goods, internalizing externalities, and enforcing competition.

Stabilization and Growth

Perhaps most importantly, the government guides the overall pace of economic activity, attempting to maintain steady growth, high levels of employment, and price stability. By adjusting spending and tax rates (fiscal policy) or managing the money supply and controlling the use of credit (monetary policy), it can slow down or speed up the economy’s rate of growth — in the process, affecting the level of prices and employment.

Direct Assistance

The government provides many kinds of help to businesses and individuals. For example, tariffs permit certain products to remain relatively free from foreign competition, imports are sometimes taxed or limited by volume so that Indian products can better compete with foreign goods.

Government also provides aid to farmers by subsidizing prices they receive for their crops. In quite a different area, government supports individuals who cannot adequately care for themselves by making grants to low-income parents with dependent children, by providing medical care for the aged and indigent, and through social insurance programs that assist the unemployed and retirees. Government also supplies relief for the poor and help for the disabled.

Direct Services

Each level of government provides direct services. The postal system, for example, is a federal system serving the entire nation, as is the large military establishment. By contrast, the construction and maintenance of most highways is the responsibility of individual state governments. The public education systems are primarily paid for by state, country or city governments. In general, police and fire protection are the responsibilities of local government.

Regulation and Control

The government regulates and controls private enterprise in many ways in order to ensure that business serves the best interests of the people as a whole. Regulation is usually considered necessary in areas where private enterprise has been granted a monopoly, such as in electric or local telephone service, or in other areas where there is limited competition, as with the railroads. Public policy permits such companies to make reasonable profits, but limits their ability to raise prices “unfairly” (as defined by the regulators) because the public depends on their services.

Police state, Laissez faire state & Welfare state

Police state

Police state is a term denoting a government that exercises power arbitrarily through the power of the police force. It is an undesirable state of living, characterized by the overbearing presence of the civil authorities in every walk of life. It is a state where the state controls all economic activities by force and not really keeping in mind the welfare of the people.

Laissez faire state

“Laissez Faire” is French word for “leave alone” which means that the government leaves the people alone regarding all economic activities. It is the separation of economy and state.

Welfare state

A welfare state is a concept of government where the state plays a key role in the protection and promotion of the economic and social well-being of its citizens. It is based on the principles of equality of opportunity. Equitable distribution of wealth, and public responsibility for those unable to avail themselves of the minimal provisions for a good life.

There are two main interpretations of the idea of a welfare state:

- A model in which the state assumes primary responsibility for the welfare of its citizens. This responsibility in theory ought to be comprehensive, because all aspects of welfare are considered and universally applied to citizens as a “right”.

Examples: laying roads, maintaining law and order, defence etc.,

- Welfare state can also mean the creation of a “social safety net” of minimum standards of varying forms of welfare.

Examples: Universal basic Income, Minimum wages Act in India etc.

Three central problems of economy

Every human society – whether it is an advanced industrial nation, a centrally planned economy, or an isolated tribal nation – must confront and resolve three fundamental economic problems. Every society must have a way of determining what commodities are produced, how these goods are made, and for whom they are produced.

Indeed, these three fundamental questions of economic organization – what, how, and for whom – are as crucial today as they were at the dawn of human civilization.

Let’s look more closely at them:

- What commodities are produced and in what quantities? A society must determine how much of each of the possible goods and services it will make and when they will be produced. Will we produce pizzas or shirts today? A few high – quality shirts or many cheap shirts? Will we use scarce resources to produce many consumption goods (like pizza)? Or will we produce fewer consumption goods and more investment goods (like pizza – making machines), which will boost production and consumption tomorrow?

- How are goods produced? A society must determine who will do the production, with what resources, and what production techniques they will use. Who farms and who teaches? Is electricity generated from oil, from coal, or from the sun? Will factories be run by people or robots?

- For whom are goods produced? Who gets to eat the fruit of economic activity? Is the distribution of income and wealth fair and equitable? How is the national product divided among different households? Are many people poor and a few rich? Do high incomes go to teachers of athletes or autoworkers or venture capitalists? Will society provided consumption to the poor or must people work if they are to eat?

Based on how the above problems are addressed the economies are classified into three types.

The 3 different types of economies

- Traditional Economies

- Market Economies

- Command Economies

Traditional economy

Is an original economic system in which traditions, customs, and beliefs help shape the goods and the services the economy produces, as well as the rules and manner of their distribution. Countries that use this type of economic system are often rural and farm-based.

Characteristics of a Traditional Economy

Traditional economies are often based on one or a few of agriculture, hunting, fishing, and gathering. Traditional economies are still found in many developing countries- in parts of Africa, Asia, South America, and the Middle East, parts of northern Canada.

Market Economy

The activity in a market economy is unplanned; the decisions are made in markets, where individuals or enterprises voluntarily agree to exchange goods and services, usually through payments of money. There is no central authority that takes or implements decision in this kind of an economy.

Command Economy

A command economy is one in which all the important decisions about production and distribution are taken by the government. The government owns the factors of production and also directs the operations of the enterprises.

Based on the Ownership and Control over Means of Production or Resources the economies are divided into three types:

Resources or means of production remain either in private ownership with full individual freedom to use them for the profit motive or they can be in collective ownership (government control) and can be used for the collective welfare of the society as a whole.

Based on the criterion of degree of individual freedom and profit motive, economies are labelled as:

- Capitalist or free enterprise economy

- Socialist or centrally planned economy

- Mixed economy

Capitalist Economy

The capitalist or free enterprise economy is the oldest form of economy. Earlier economists supported the policy of ‘laissez fair’ meaning ‘leave free’. They advocated minimum government intervention in the economic activities.

The following are the main features of a capitalist economy;

- Private property: In a capitalistic system all the individuals have the right to own property. An individual can acquire property and use it for the benefit of his own family. There is no restriction on the ownership of land, machines, mines, factories and to earn profit and accumulate wealth. After the death of a person the property or wealth is transferred to the legal heirs. Thus the institution of private property is sustained over time by the right of inheritance.

- Freedom of enterprise: In a capitalist economy the government does not coordinate production decisions of the citizens. Individuals are free to choose any occupation. Freedom of enterprise implies that business firms are free to acquire resources and use them in the production of any good or service. A worker is free to choose his/her employer. In small business units owner himself takes the risk of production and earns profit or loss for himself.

- Consumer’s Sovereignty: In a capitalist economy consumers are like a king. They have the full freedom to spend their income on goods and services that give them maximum satisfaction.

- Profit Motive: Self-interest is the guiding principle in capitalism. Therefore entrepreneurs are always motivated to maximize their residual profit by minimizing cost and maximizing revenue.

- Competition: There are no restrictions on the entry and exit of firms in a capitalism system. Competition is the fundamental feature of capitalist economy and essential to safeguard against consumer’s exploitation.

- Importance of markets and prices: Capitalism is essentially a market economy where every commodity has a price. The forces of demand and supply in an industry determine this price. Firms which are able to adjust at a given price earn normal profit and those who fail to do so often quit the industry.

- Absence of government interference: In a free enterprise or capitalist economy the price system plays an important role of coordinating agent. Government intervention and support is not required. The role of government is to help in free and efficient functioning of the markets.

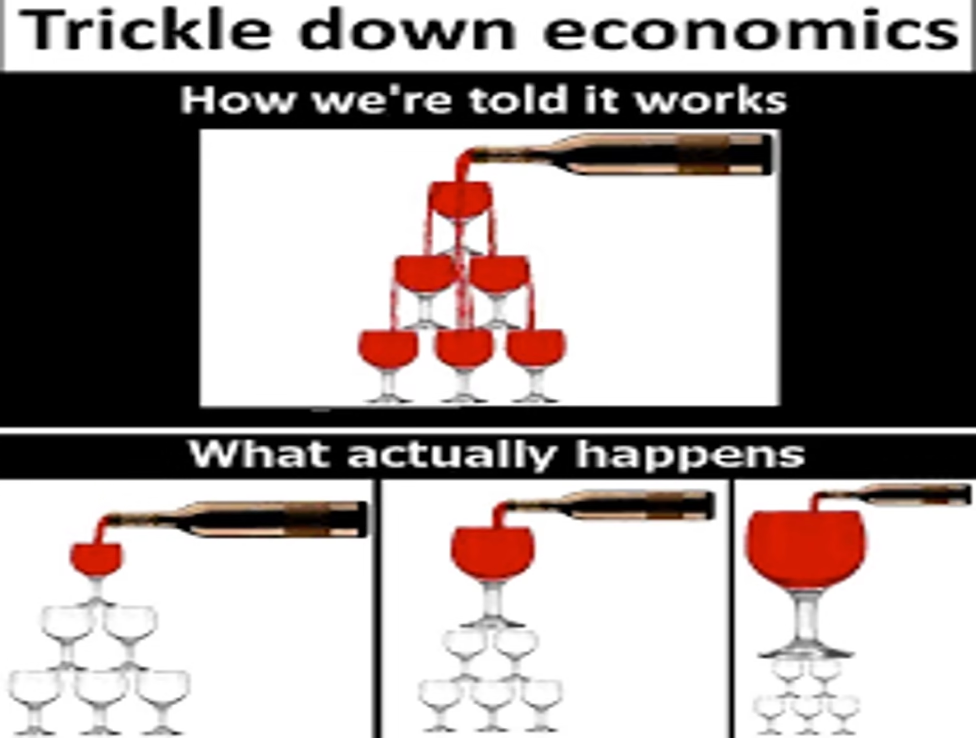

Disadvantages of Capitalism

- Monopoly power: Private ownership of capital enables firms to gain monopoly power in product and labour markets. Firms with monopoly power can exploit their position to charge higher prices.

- Social benefit ignored: A free market will ignore externalities. A profit maximising capitalist firm is likely to ignore negative externalities, such as pollution from production; this can harm living standards. Similarly, a free market economy will under-provide goods with positive externalities, such as health, public transport and education. This leads to an inefficient allocation of resources.

- Inherited wealth and wealth inequality: A capitalist society is based on the legal right to private property and the ability to pass on wealth to future generations. Capitalists argue that a capitalist society is fair because you gain the rewards of your hard work. But, often people are rich, simply because they inherit wealth or are born into a privileged class. Therefore, capitalist society not only fails to create equality of outcome but also fails to provide equality of opportunity.

- Inequality creates social division: Societies which are highly unequal create resentment and social division.

- Diminishing marginal utility of wealth: A capitalist society argues it is good if people can earn more leading to income and wealth inequality. However, this ignores the diminishing marginal utility of wealth. A millionaire who gets an extra million sees little increase in economic welfare, but that £1 million spent on health care would provide a much bigger increase in social welfare.

- Boom and bust cycles: Capitalist economies have a tendency to booms and busts with painful recessions and mass unemployment.

Socialist Economy

In the socialist or centrally planned economies all the productive resources are owned and controlled by the government in the overall interest of the society. A central planning authority takes the decisions.

The socialist economy has the following main features:

- Collective Ownership of means of Production: In a Socialist economy means of production are owned by the government on behalf of the people. The institution of private property is abolished and no individual is allowed to own any production unit and accumulate wealth and transfer it to their heirs. However, people may own some durable consumer goods for their personal use.

- Social Welfare Objective: The decisions are taken by the government at macro level with the objective of maximization of social welfare in mind rather than maximization of individual profit. The forces of demand and supply do not play any important role.

- Central Planning: Economic planning is an essential feature of a socialist economy. The Central Planning Authority keeping the national priorities and availability of resources in mind allocates resources. The planning authorities fix targets for various sectors and ensure efficient utilization of resources.

- Reduction in Inequalities: The institutions of private property and inheritance are at the root of inequalities of income and wealth in a capitalist economy. By abolishing these twin institutions a socialist economic system is able to reduce the inequalities of incomes. It is important to note that perfect equality in income and wealth is neither desirable nor practicable.

- No class conflict: In capitalist economy the interests of the workers and management are different. Both of them want to maximize their own individual profit or earnings. This results in class conflict in capitalist economy. In socialism there is no competition among classes. Every person is a worker so there is no class conflict. All are co-workers.

Disadvantages of Socialism

- Elimination of Individualism: In socialist economic system everything is controlled by a centralized body. Individuals are not allowed to own any assets, everything belongs to the state. Workers are assigned specific jobs and are not allowed to change them without consent from the planning authority.

- Red-Tapism and Inefficiency: In socialism there is a lot of involvement of bureaucracy and are the drivers of all economic machinery. The work of civil servants are not comparable with the private entrepreneurs. Civil servants merely do the jobs because it is their duty and they will get paid whatever the consequences. Thus inefficiency arises and in the long run the economy suffers.

- An Artificial System: As a socialist economy is a planned economy, every aspect of the economy is to be determined by the government. Forces of demand and supply do not apply which is one of the disadvantages of socialism.

- Consumers Suffer: Sovereignty of consumer does not apply in a socialist economy. Consumers do not enjoy the status of a consumer as in a capitalist economy. Choices of goods and services are not able to maximize their total satisfaction.

- Economic Equality: Socialists claim more equal distribution of wealth but practically it is proven that complete economic equality is virtually impossible. There is a distinction between the rich and poor. Moreover since it is a planned economy the poor suffer even more.

- Loss of Liberty: One of the main dangers of socialism is that it not only curtails individual liberty but also take away freedom completely. Under socialism there is no scope for consumers sovereignty; the workers will have no choice of occupation, and labour, just like any other economic resource, will be under planned management. The consumers should take what is given and workers should work in such places as the authorities will decide. Of course, there will be no unemployment, but this is hardly an advantage because the terms of employment (hours, wages etc.,) will be fixed by the central authorities. Security of employment is no compensation for loss of liberty. There is no unemployment even in prison.

- Non-existence of Competition: It is due to competition that an economy becomes prosperous. The competition between producers and consumers leads to the production of a good quality product which may even be relatively cheap here it is one the disadvantages of socialism. Thus talents and initiatives of mankind develop and in the ultimate analysis the country incurs rapid growth.

Mixed Economy

A mixed economy combines the best features of capitalism and socialism. Thus mixed economy has some elements of both free enterprise or capitalist economy as well as a government controlled socialist economy. The public and private sectors co-exist in mixed economies. The main characteristics of a mixed economy are as follows:

- Co-existence of public and private sectors: The private sector consists of production units that are owned privately and work on the basis of profit motive. The public sector consists of production units owned by the government and works on the basis of social welfare. The areas of economic activities of each sector are generally demarcated.

- Individual Freedom: Individuals take up economic activities to maximize their personal income. They are free to choose any occupation and consume as per their choice. But producers are not given the freedom to exploit consumers and labourers. Government puts some restrictions keeping in mind the welfare of the people.

- Economic Planning: The government prepares long-term plans and decides the roles to be played by the private and public sectors in the development of the economy. The public sector is under direct control of the government as such production targets and plans are formulated for them directly. The private sector is provided encouragement, incentives, support and subsidies to work as per national priorities.

- Price Mechanism: Prices play a significant role in the allocation of resources. For some sectors the policy of administered prices is adopted. Government also provides price subsidies to help the target group. The aim of the government is to maximize the welfare of the masses.

Thus in a mixed economy people at large enjoy individual freedom and government support to protect the interests of weaker sections of the society.

Indian economy is considered a mixed economy as it has well defined areas for functioning of public and private sectors and economic planning. Even countries such as USA, UK, etc. which were known as capitalistic countries are also called mixed economies now because of active role of their government in economic development.

Types of Economics on the Basis of Level of Development

Developed economy

The countries are labelled developed or rich and developing or poor on the basis of real national and per capita income and standard of living of its population. Developed countries have higher national and per-capita income, high rate of capital formation i.e. high savings and investment. They have highly educated human resources, better civic facilities, health and sanitation facilities, low birth rate, low death rate, low infant mortality, developed industrial and social infrastructures and a strong financial and capital market. In short, developed countries have high standard of living.

Developing economy

Developing countries are low on the ladder of development. They are sometimes also called underdeveloped, backward or poor countries. But economists prefer to call them developing countries because it gives a sense of dynamism. The national and per capita income is low in these countries. They have backward agricultural and industrial sectors with low savings, investment and capital formation. Although these countries have export earnings but generally they export primary agricultural products. In short, they have low standard of living and poor health and sanitation, high infant mortality, high birth and death rates and poor infrastructure.

Sectors of an economy

All economic activity can be classified into one of three sectors: the primary sector, the secondary sector and the tertiary sector. As a rule of thumb, we say the more advanced an economy is, the more its focus shifts from the primary, through the secondary to the tertiary sector. In recent years, many economists have argued that the three-sector theory should be extended to include a quaternary sector.

Primary Sector

The primary sector describes all industries that are engaged in the extraction of natural resources or the production of raw materials. This includes industries such as forestry, mining, farming or fishing. The primary sector is the most basic sector because in its simplest form it does not require a lot of advanced machinery.

Therefore, in traditional economies, it is usually the strongest sector in terms of employment. However, in more advanced economies, heavy machinery can be used to significantly increase efficiency and reduce the number of workers needed in primary sector industries.

In other words, employment numbers in this sector tend to decrease, as economies develop. As a result, in most modern economies the primary sector only makes up about 10% of total employment.

Secondary Sector

The secondary sector includes all industries that are concerned with the manufacturing of usable products or finished goods. It is often divided further into heavy industry and light industry. Examples of heavy industry include steelmaking, mining, as well as the production of chemicals, automotive, aircraft, and so on. On the other hand, light industry includes the manufacturing of food, beverages, cosmetics, clothes, home electronics, etc.

Both heavy and light industries use the raw material (i.e. output) from the primary sector and process it to the point where the resulting products can be used by other companies for further production or by consumers as finished goods. Many of the industries associated with the secondary sector require heavy machinery, consume large quantities of energy and produce a lot of waste during the production process. Nevertheless, the secondary sector is usually the strongest sector in transitional economies. In modern economies it still employs about 20% of the workforce.

Tertiary Sector

The tertiary sector describes all industries that provide services to other businesses or final consumers. It is sometimes also referred to as the service sector or service industries. Examples of tertiary sector industries include retail, health care, financial services, entertainment and many others. Unlike the two preceding sectors, the tertiary sector focuses on interactions between people rather than the production of goods. However, many of the service industries still rely on goods produced in the primary and secondary sector to offer their services. As economies develop, more processes can be industrialized and automated. As a result, an increasing number of industries shift their focus towards the tertiary sector. Thus, in modern economies the tertiary sector employs about 70% of the workforce.

Quaternary sector

The quaternary sector includes all industries that are concerned with the creation and distribution of knowledge. This sector has emerged a few years ago as a further distinction of the tertiary sector.

Many economists argue that knowledge-based industries are distinct enough from classical service industries to warrant a separate sector. Thus, examples of quaternary sector industries include research and development, education, information technology, consulting, etc.

Although this idea has become increasingly popular in recent years, the definition and scope of a quaternary sector are not clearly defined yet, which results in a number of different approaches that each focus on a different set of industries.

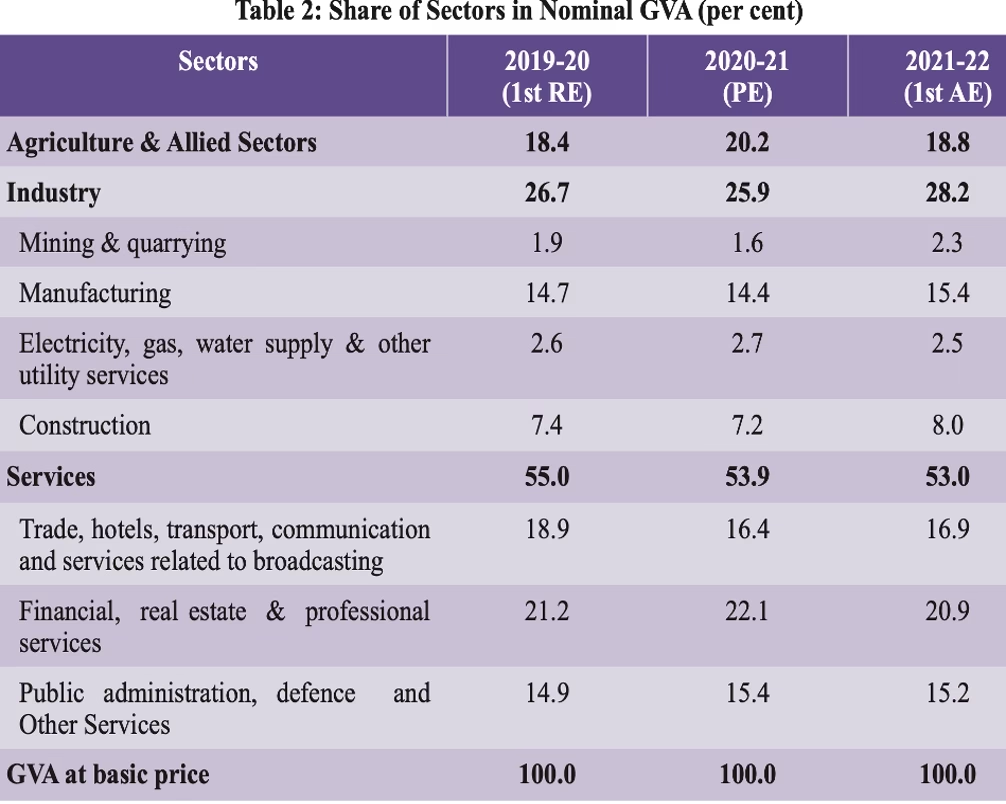

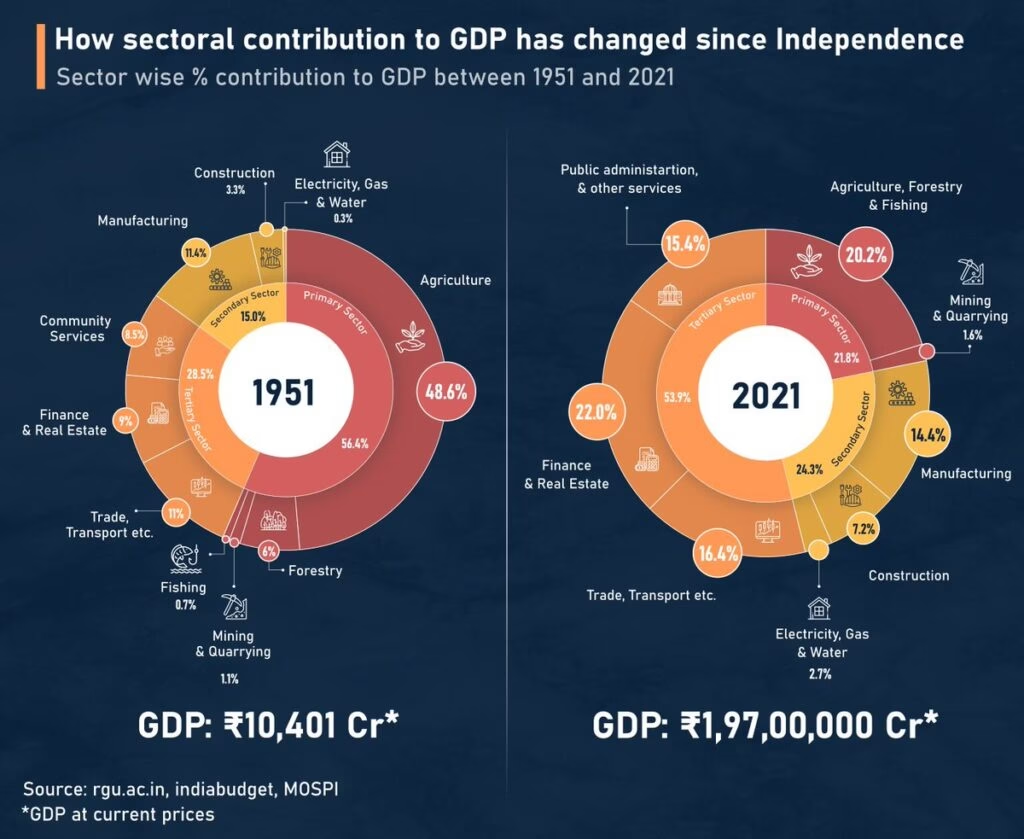

Sectors of Indian Economy

1.Agriculture, forestry and Fishing

2.Industry

- Mining and quarrying

- Manufacturing

- Electricity, gas, water supply and other utility services

- Construction

3.Service Sector

- Trade, hotel, transport, storage, communication & service related to broadcasting.

- Financial, real estate & professional services

- Public administration, defence and other services.

Open and Closed Economy

A closed economy is self-sufficient, meaning no imports are brought in and no exports are sent out, the goal being to provide consumers with everything they need from within the economy’s borders.

Examples of countries with closed economy: We probably might not be able to come across many such countries in the present day world, however with the slight exception of North Korea, because of the following reasons. Maintaining a closed economy is difficult in modern society, where certain raw materials, such as crude oil, have such a vital role as inputs and final goods; a country is forced to import if these resources are not naturally within its borders. Closed economies run counterintuitive to modern, liberal economic logic, which preaches opening up domestic markets to international markets to capitalize on comparative advantages and gains from trade. Through the specialization of labour and allocation of resources to their most productive, efficient means, a person is able to become wealthier.

An open economy is an economy in which there are economic activities between the domestic community and outside. People and even businesses can trade in goods and services with other people and businesses in the international community, and funds can flow as investments across the border.

Formal Vs Informal Sectors

Which are also referred to as organised and unorganised sectors. All the public sector establishments and those private sector establishments which employ 10 hired workers or more are called formal sector establishments and those who work in such establishments are formal sector workers.

The sector, which is registered with the government is called an organised sector. In this sector, people get assured work, and the employment terms are fixed and regular.

A number of acts apply to the enterprises, schools and hospitals covered under the organised sector. Entry into the organised sector is very difficult as proper registration of the entity is required. The sector is regulated and taxed by the government.

There are some benefits provided to the employees working under organised sector like they get the advantage of job security, add on benefits are provided like various allowances and perquisites. They get a fixed monthly payment, working hours and hike on salary at regular intervals.

Informal sectors: Informal sector includes millions of farmers, agricultural labourers, owners of small enterprises and people working in those enterprises as also the self-employed who do not have any hired workers.

The sector which is not registered with the government and whose terms of employment are not fixed and regular is considered as unorganised sector. In this sector, no government rules and regulations are followed. Entry to such sector is quite easy as it does not require any affiliation or registration. The government does not regulate the unorganised sector, and hence taxes are not levied. This sector includes those small size enterprises, workshops where there are low skill and unproductive employment.

The working hours of workers are not fixed. Moreover, sometimes they have to work on Sundays and holidays. They get daily wages for their work, which is comparatively less than the pay prescribed by the government.

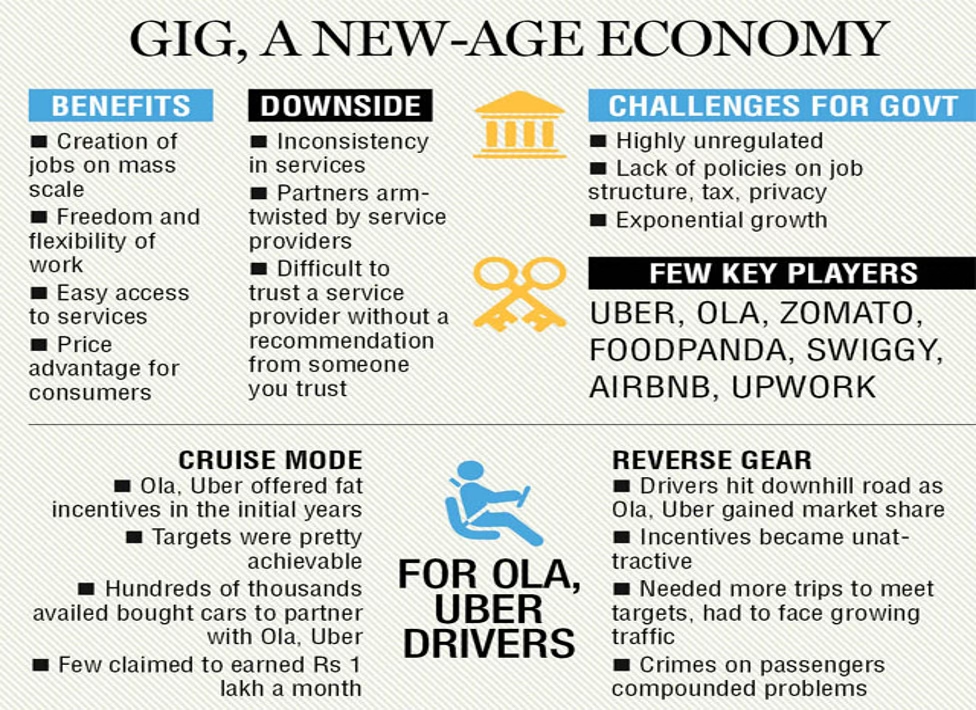

Gig Economy

A gig economy is a free market system in which temporary positions are common and organizations hire independent workers for short-term commitments. The term “gig” is a slang word for a job that lasts a specified period of time; it is typically used by musicians. Examples of gig employees in the workforce could include work arrangements such as freelancers, independent contractors, project-based workers and temporary or part-time hires.

There has been a trend toward a gig economy in recent years. There are a number of forces behind the rise in short-term jobs. For one, the workforce is becoming more mobile and work can increasingly be done remotely via digital platforms. As a result, job and location are being decoupled. That means that freelancers can select among temporary jobs and projects around the world, while employers can select the best individuals for specific projects from a larger pool than what’s available in any given area.

Digitization has also contributed directly to a decrease in jobs as software replaces some types of work to maximize time efficiency. Other influences include financial pressures on businesses leading to a flexible workforce and the entrance of the millennial generation into the labour market. People tend to change jobs several times throughout their working lives, especially millennials, and the gig economy can be seen as an evolution of that trend.

The gig economy is part of a shifting cultural and business environment that also includes the sharing economy, the gift economy and the barter economy. The cultural impact of the gig economy continues to change, for example, with the advent of COVID-19 in 2020 — where the pandemic has had a large influence.